When It’s All Fun and Games: Gamification Ideas for Banking Services to Engage Customers

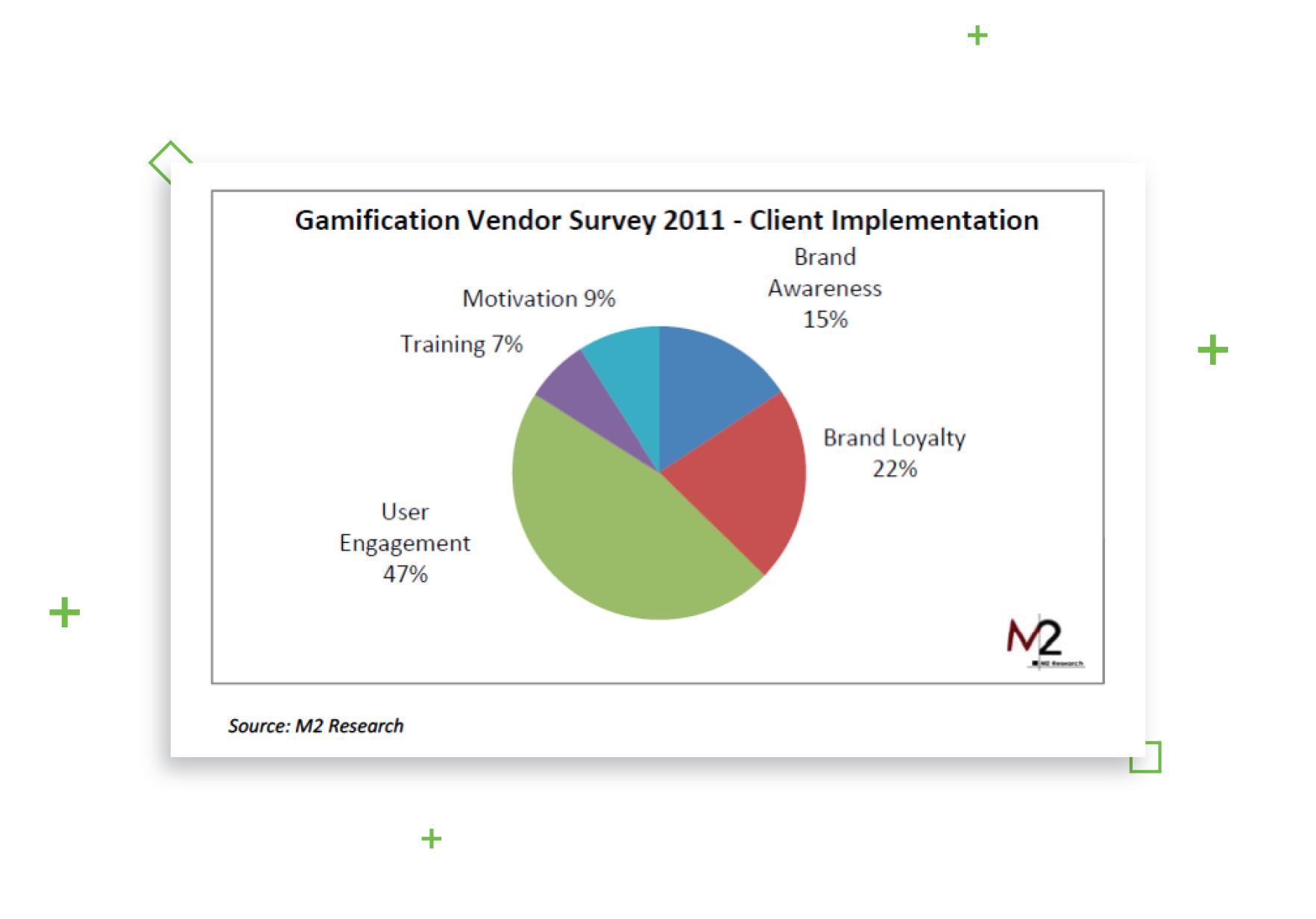

Gamification has proven to be a great tool for engaging audiences in different areas, including healthcare and education. In more conservative industries, like banking, gamification has met with a great deal of skepticism.

As it is, the gamification market is a promising field. In fact, it is expected to grow to a whopping $19 billion by 2023.

In this article, you will find all necessary information about what gamification in banking is, how to apply it in practice, how implement it in the fintech app development process, some gamification ideas in banking that you can benefit from.

Our fintech development company also gives a few real-life gamification in banking examples.

What does gamification mean?

Gamification means applying gameplay principles and game design elements in a non-game environment. Game mechanics can be used to engage more audiences, reduce workplace stress, boost productivity – and, as a result, reach a business goal. Here, we will discuss how game mechanics can help you influence your clients’ behavior.

The gamification principles

The idea of gamification is not about turning something into a game but applying the principles of game mechanics to:

- Engage and motivate the audience. It creates a challenge and feeds the feeling of accomplishment that most people crave.

- Make a fun activity out of a boring one. It is well received in education because students get bored with simply memorizing facts and solving equations all the time. And when people get bored, they lose focus. The same goes for your clients. Subconsciously, they will lean toward services that are more fun.

- Change behavior. It helps people acquire new skills by rewarding certain behaviors. For example, you can help customers shape their money-saving skills.

- Introduce more complex concepts. Game elements can boost one’s motivation to acquire knowledge (e.g., learn about different types of credit cards). As an educational approach, gamification can also be used to raise awareness about new or existing services.

Here are some game elements that can be used for this purpose:

- Extrinsic motivation — rewards that make you want to continue performing an action that is not rewarding in itself. Extrinsic motivators include:

- Points;

- Badges;

- Leaderboards.

- Intrinsic motivation — internally satisfying and doesn’t require a material reward. Instead, it may provide:

- Relatedness;

- Autonomy;

- Mastery;

- Purpose.

This is not to say that you can’t use actual games in the context of gamification. A good banking industry example would be an online game that allows users to build a financial empire. In this case, you are engaging the audience with a fun game, but they are also learning the principles of good financial investment along the way (educational aspect) and shaping the skills of smart investing (behavioral aspect).

How does it work? Gamification ideas for banking

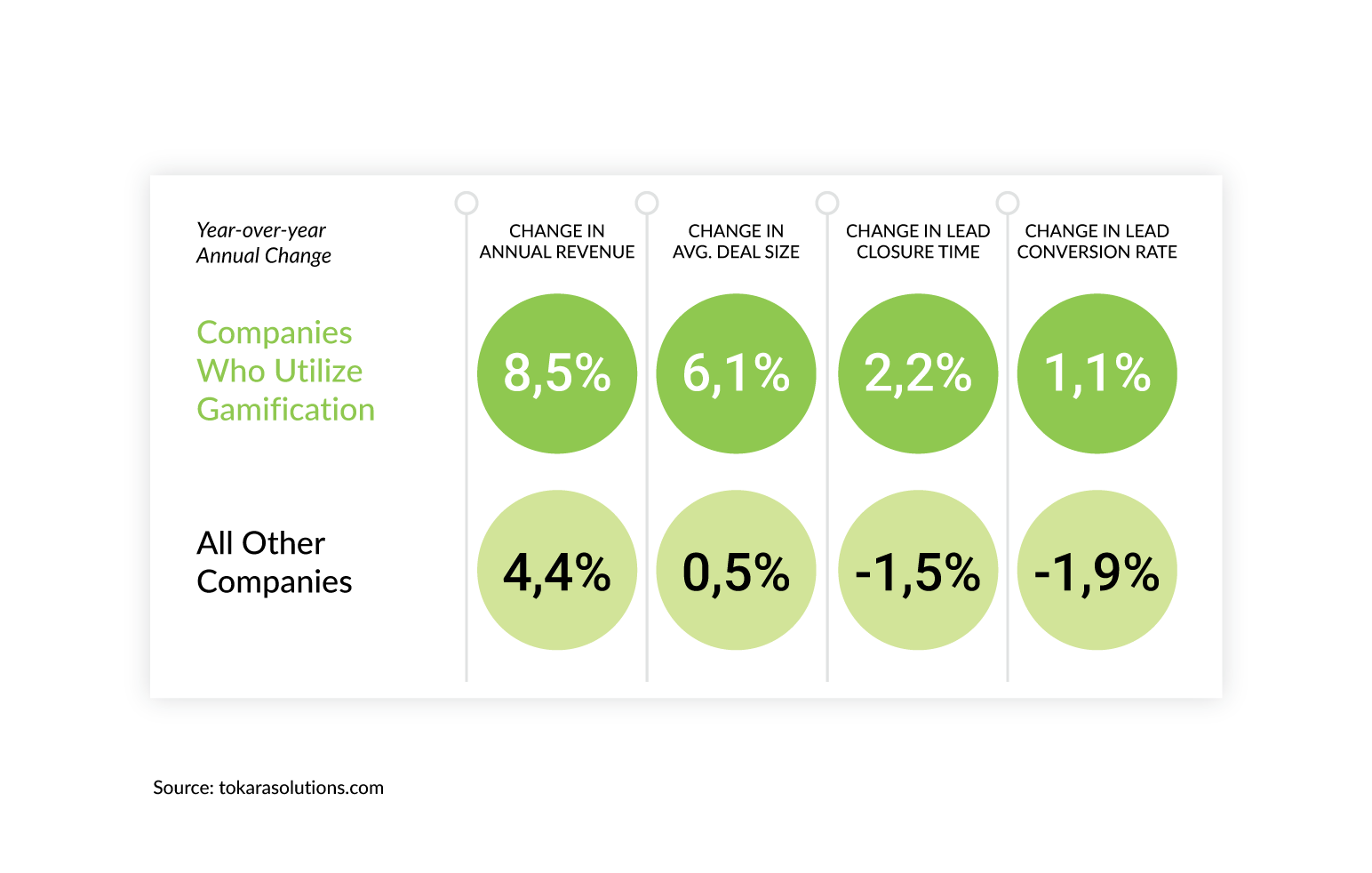

Gamification in finance and banking is a great tool for engaging your customers and motivating them to keep using your services, but it can also be used to attract new clients.

Let’s review some of the ways in which you can attract and retain customers using gamification:

1. Hold contests, give rewards. One of the most common techniques to attract new clients is to give them something of value for satisfying certain conditions, like participating in a referral program. For example, Payoneer offers $25 to both an Affiliate and the person who registers with the service via a link.

2. Give points for shopping. It’s easy to find people who have played Mario Bros or other games where you collect coins while completing a quest. You can take the same idea into shopping with a card issued by your bank. One of the most simple gamification ideas for banking: users earn points (coins) for shopping with retailers you partner with; later, they can redeem points for gift cards. You can boost motivation by raising the stakes to a grand prize (like a trip) that only the most active players can win.

3. Keep the game simple and easy to win. Remember that the point is to make it fun, entertaining, and easy to perceive. If the user needs to work too hard to earn rewards, they will soon lose interest.

4. Incorporate social media. Add an option that allows users to share their accomplishments, the contests they participate in, or any features they like with their friends and followers on social media. Aside from engaging the audience, you also get passive advertising, since your customers are spreading the word about your product or services.

5. Use gameplay to educate customers. Puzzles, quizzes, short videos or actual games can be used to elaborate or uncover a topic. For example, customers can earn redeemable points (motivation) for watching educational videos about finance-related activities. This way, you raise awareness about financial topics among your customers so they can make smarter decisions about their bank accounts and investments.

6. Promote new services with gameplay. There are fun ways for clients to learn about your services and features aside from straightforward advertising. For example, it could be a short video in which the main character goes through a series of troubles that your product solves. If you don’t have the talent required in-house you can always use video production services to help you develop engaging video content.

Best examples of gamification in banking services

There are numerous ways to incorporate game design into your business, but it’s hard to see the value in theory. Here are some gamification examples in financial services that show how the ideas can work in practice.

BBVA Game

For the Spanish bank, gamification strategy brought them the Bank Innovation Award in 2013 and staggering 100,000 players in the first six months after releasing the BBVA game. It’s a simple platform based on a points system where users can win different prizes, like football match tickets or music downloads. Later, they created other games that focus on money savings and educating children about budget management.

Value. Using the BBVA game is akin to using an ordinary bank account, only times more fun. You still perform your usual transactions, like paying taxes or bills, but the game environment and the points system motivates customers to actually use the online banking services.

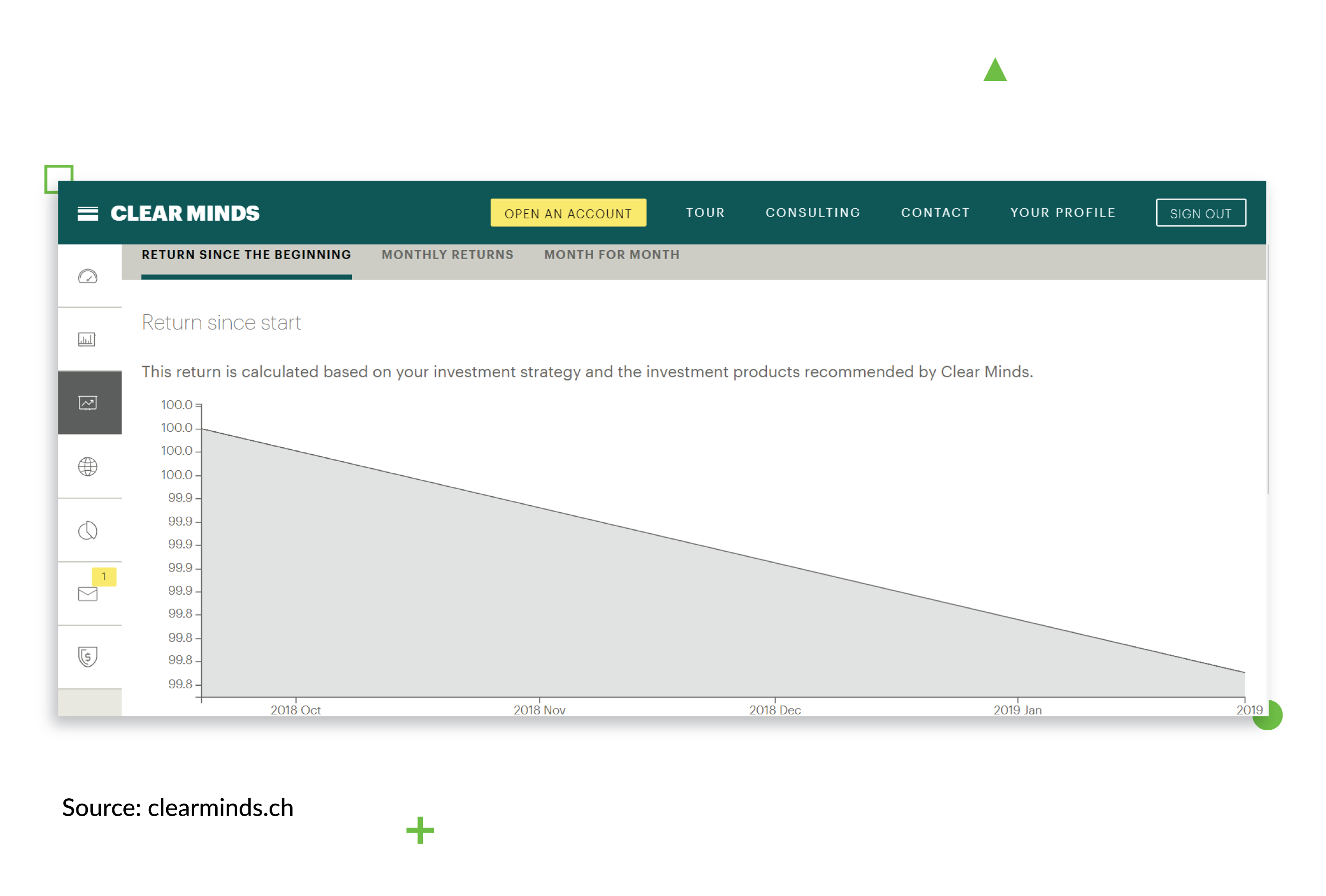

Clear Minds

The online investment platform Clear Minds helps user invest money into promising markets and industries. First, you register and set a target you want to earn. The platform then estimates where you should invest your money while an analyst calculates the risks. The platform can also show how much you could have earned if you’d invested, for example, 10 years ago (‘Historical performance’ feature). Additionally, you can estimate how much you could earn if you invest money right after registering (‘Hypothetical portfolio’ feature).

Value. The platform makes investments more ‘user-friendly’. There is no need to acquire deep knowledge of the stock market or go anywhere but the website. This encourages more people to invest their money since the whole process is simplified and supported for an ordinary end-user.

Read also our guide on how to build an investment platform.

Emirates NBD fitness app

Emirates NBD is a great example of how gamification for the finance industry can be as beneficial for the customer’s wellness and wallet, as it is for the company itself. The app encourages users to connect a fitness account where the can track their daily activities. It has levels and challenges that allow you to earn redeemable points and a progress bar to track your effort. If a user reaches a goal (12,000 steps a day), they get a 2% interest rate.

Value. In addition to the interactivity, it has the financial factor which is a good motivator for people facing debt, as well as health issues. All the motivators resulted in a grand total of 53 mil steps just in the first month of launching the app. NBD has also earned $230,000 in media endorsements pithing the first year and brand partnerships with companies like Adidas and Apple.

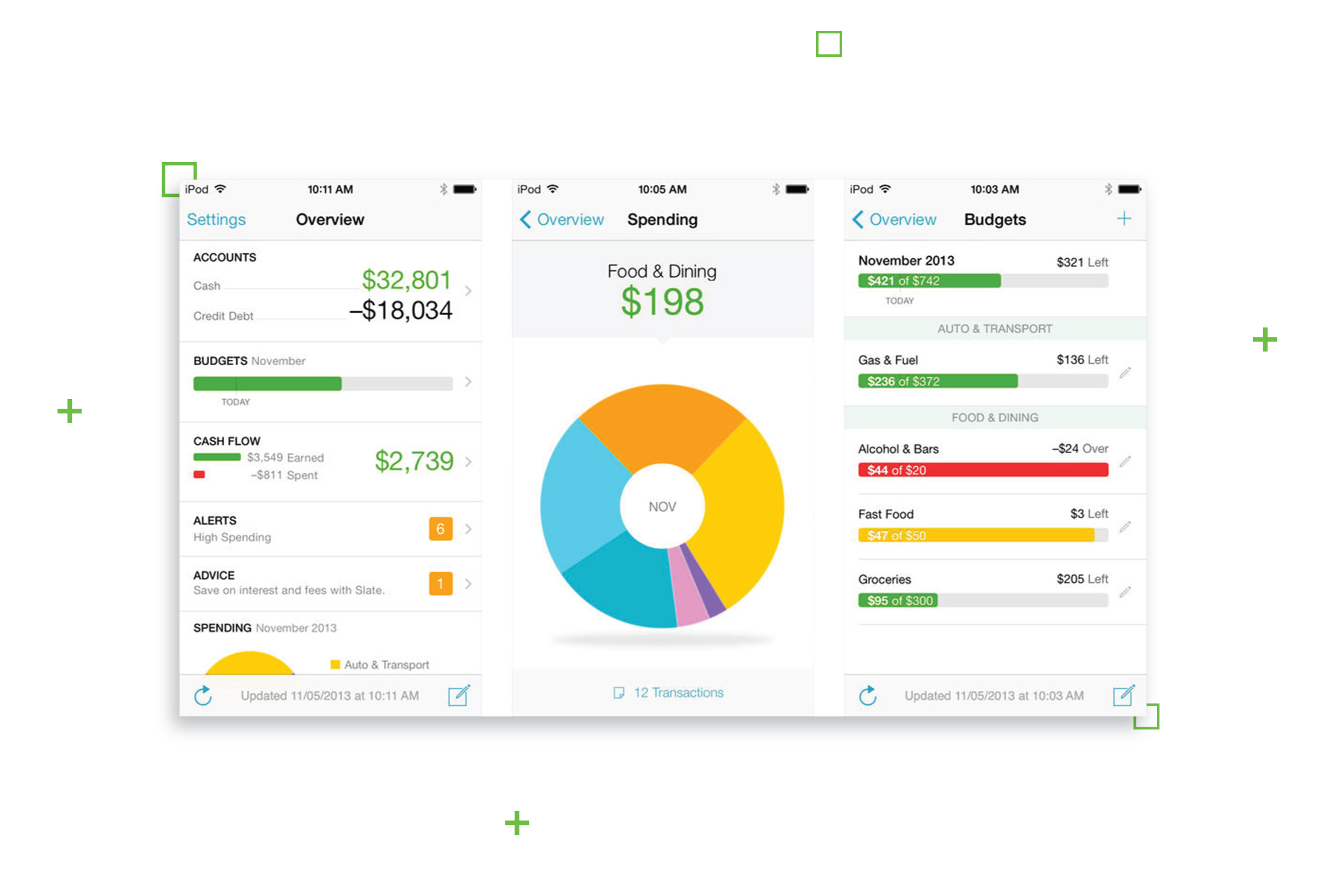

Mint

It’s an online platform for managing personal finances. Mint allows you to set goals and manage them (see your progress), track your expenses, investments, and credit scores. The simple user interface helps make sense of all your financial transactions (‘Where does the money go?’) and personal budget. It will also remind you when you need to pay the bills or if you have late fees.

Value. Mint accounts allow the company to collect information about user financials (spending habits, retirement accounts) and offer relevant services where you can make money (referral fees).

Examples of gamification platforms and applications

NBD, Clear Minds, BBVA, DSK, and Mint are all examples of a single company gamifying their services for many users. But, how can the business implement gamification in the digital banking product? There are several platforms that help to get gamification in the game.

Foursquare Check-Ins

Foursquare is a gamified GPS-based platform where users can discover new places and win badges for check-ins. In 2014 it split into Foursquare City Guide (for exploring nearby locations) and Foursquare Swarm (a lifelog of visited places). Using both platforms, you can earn stickers, bonuses, coins, and climb through levels to become a Superuser by checking-in, reviewing establishments, and being active in general.

Banks and financial companies, like many other businesses, started using the platform for promoting their service. For example, Dupaco Credit Union offered a free koozie for all first-time check-ins and a chance to win a $50 gas card, and those who frequent a specific branch get the title ‘mayor’.

Value: Thanks to the introduction of badges, Foursquare grew to 10 million users in 2009, and now it has around 50 million active users per month. If you claim your business in the City Guide, you can use Foursquare and Swarm functionality to promote your business.

Pokemon Go

The game turned into a social platform is akin to the Foursquare Swarm gamification example. A business can request a PokeStop at their establishment that will show up on the player’s map, which can also be nominated by users. You can encourage players to check-in at your location while playing Pokemon Go to increase your social media presence, and also share photos of the Pokemon they’ve caught at your location.

Value. The idea of Pokemon Go was to get people out of their homes and exploring the city. Business owners picked it up rather quickly and now they use Pokemon Go as a way of attracting customers to their establishments.

Badgeville’s LevelEleven

LevelEleven is a slightly different kind of gamification service, yet it can be effectively used in banks and FinTech companies. It is a sales management system for gamifying the sales process inside a company. For example, you can create sales contests for boosting productivity and incentivizing excitement instead of feeling pressured. Employees can also earn points for different behavior.

Value. The platform helps companies drive sales and encourage healthy competition. It allows any business to motivate, engage, and coach their sales team. You can also customize the system according to your business needs.

Conclusion

Some companies use quizzes, puzzles, and educational videos to help their clients make smarter choices about their finances. Others offer customers fun ways to visualize “boring” numbers, such as by letting them play plug in numbers to see the outcomes of different investment opportunities.

Whether it is an actual game or the principles of gaming used to encourage the customers to use banking services, the best examples of gamification in the banking industry show that it is a powerful tool that can boost motivation and engage audiences by providing them with simple and fun activities.

Gamification in banking apps is a great opportunity to attract new customers and engage existing ones, but if you’re still on the pre-development stage of the product, you may find useful our article about banking application development. Check it out and create you own plan on how to make a product that people will like to use.

Also, you can check out our case studies in banking and finance. Let the Django Stars team know if you are interested in software consultancy or product development services.

- Why use gamification in banking services?

- Game mechanics can be used to engage more audiences, reduce workplace stress, boost productivity – and, as a result, reach a business goal.

- How to use gamification in banking for clients and staff?

- Some companies use quizzes, puzzles, and educational videos to help their clients make smarter choices about their finances. Others offer customers fun ways to visualize “boring” numbers, such as by letting them play plug in numbers to see the outcomes of different investment opportunities.

- What gamification ideas did Django Star's team use in their fintech projects?

- An excellent example is the online investment platform Clear Minds. While making investments more ‘user-friendly’, the platform can also show how much you could have earned if you’d invested, for example, 10 years ago. Additionally, you can estimate how much you could earn if you invest money right after registering. Without requiring deep knowledge of the stock market, the platform encourages more people to invest their money since the whole process is simplified and supported for an ordinary end-user.

- How to attract and retain customers using gamification?

- Here are some of the gamification ideas for banking:

- Hold contests, give rewards.

- Give points for shopping.

- Keep the game simple and easy to win.

- Incorporate social media.

- Use gameplay to educate customers.

- Promote new services with gameplay.