A dynamic back office is the new business superpower

The CFO is ascending. Earlier this year, Fortune reported that in the first half of 2022, 8.1% of CFOs at Fortune 500 and S&P 500 companies were promoted to CEO—up from 5.6% a decade earlier. The jump reflects how business success and financial agility have become inseparable.

It’s also consistent with our own recently released CFO insights report, which found that 68% of finance leaders believe that streamlining financial operations is an essential part of their company’s strategic growth. They see it as a prerequisite for entering new markets and launching new business models.

Those kinds of opportunities are why we built our revenue and finance automation suite, a set of modular products that help finance teams automate, adapt, and scale their work. The core products—Billing; Revenue Recognition; Data Pipeline; Invoicing; Tax; and Sigma, our data analytics product—integrate effortlessly with Stripe Payments, allowing businesses to reduce operating costs while growing revenue.

This week we’re excited to announce new features that help businesses grow revenue, streamline the back office, and improve insights and decision-making.

Tools to grow revenue

The returns from improving back-office systems can be huge. Eighty-seven percent of Stripe invoices are paid within 24 hours, and Billing’s revenue recovery tools alone helped users recover $2.5 billion of revenue that would have been lost to churn in the first half of 2023.

We’ve added new features to the revenue and finance automation suite that directly translate back-office performance into revenue growth.

1. New revenue recovery features

Revenue recovery is a key part of how Stripe Billing maximizes revenue: we use machine learning to retry failed recurring payments at the optimal time, based on hundreds of dynamic signals. Our Smart Retries algorithm continuously gets better, and we’ve improved the recovery rate by 15.5% in 2023.

Deliveroo has recovered more than £100 million in revenue with Billing’s revenue recovery features. “The work Stripe has done to improve payment success rates, from the use of Stripe Billing to rapidly enabling Deliveroo Plus, makes it clear why Stripe is embedded in some of our largest initiatives,” said Will Shu, cofounder and CEO of Deliveroo.

2. Tax in more markets for faster market expansion

One of the best ways for businesses to grow revenue is to enter new markets, but they’re often stymied by the tax complexity that comes with it. We built Stripe Tax to solve that problem. Businesses can sell cross-border, and Tax takes care of tax collection for them, automatically. Now, Tax just got better, with support for 10 new countries (bringing the total number of countries supported to 50, including all of the EU).

3. Tax for platforms

For a long time, platforms have generated revenue—and value for their customers—by offering and monetizing Stripe Payments. Increasingly, we’re making it easy for platforms to offer other Stripe products in the same way, allowing them to differentiate their offerings, open new revenue streams, and provide added value to their users.

That now includes Tax. Platforms using Stripe Connect can offer Tax as a service to their connected accounts, providing them with a more unified solution, and making it easier for platform users to meet their sales tax, VAT, and GST obligations automatically.

“Stripe allows us to turn on new markets instantly and move at the pace that meets our customers’ growing and changing needs. I’d estimate we move twice as fast as we would with any other platform,” said Peter Fitzpatrick, vice president of commerce at Thinkific.

Tools to streamline the back office

If software is not implemented carefully, it can easily create new burdens of its own. In the CFO insights report, 63% of finance teams said they now use more than 10 different systems to get a unified view of their company’s financials, and 55% said they want to consolidate the number of software programs they use within the next two years. To help, we’re adding new features to the revenue and finance automation suite that allow businesses to operate across multiple systems more easily, while accessing real-time data insights faster.

1. More visibility into Stripe-originated emails

One of the key components of any billing system is communicating with customers about their payments. Stripe Billing offers the option to automate some of those communications by sending emails to your customers on your behalf regarding issues like support tickets, disputes, or refunds.

We’ve just launched new Billing features that show users what emails businesses ask Stripe to send on their behalf, including automated dunning emails. This enhanced visibility on the customer details page simplifies workflows, so you know exactly which communications a customer has received automatically, and you can more easily determine whether manual intervention is required to recover revenue.

2. New Revenue Recognition features

After a business receives a payment, their back office goes to work. Right now too much of that work is done manually—our CFO insights report found that 45% of finance teams spend more than 10 hours each month addressing data errors manually. This costs businesses time and money, and bogs down growth.

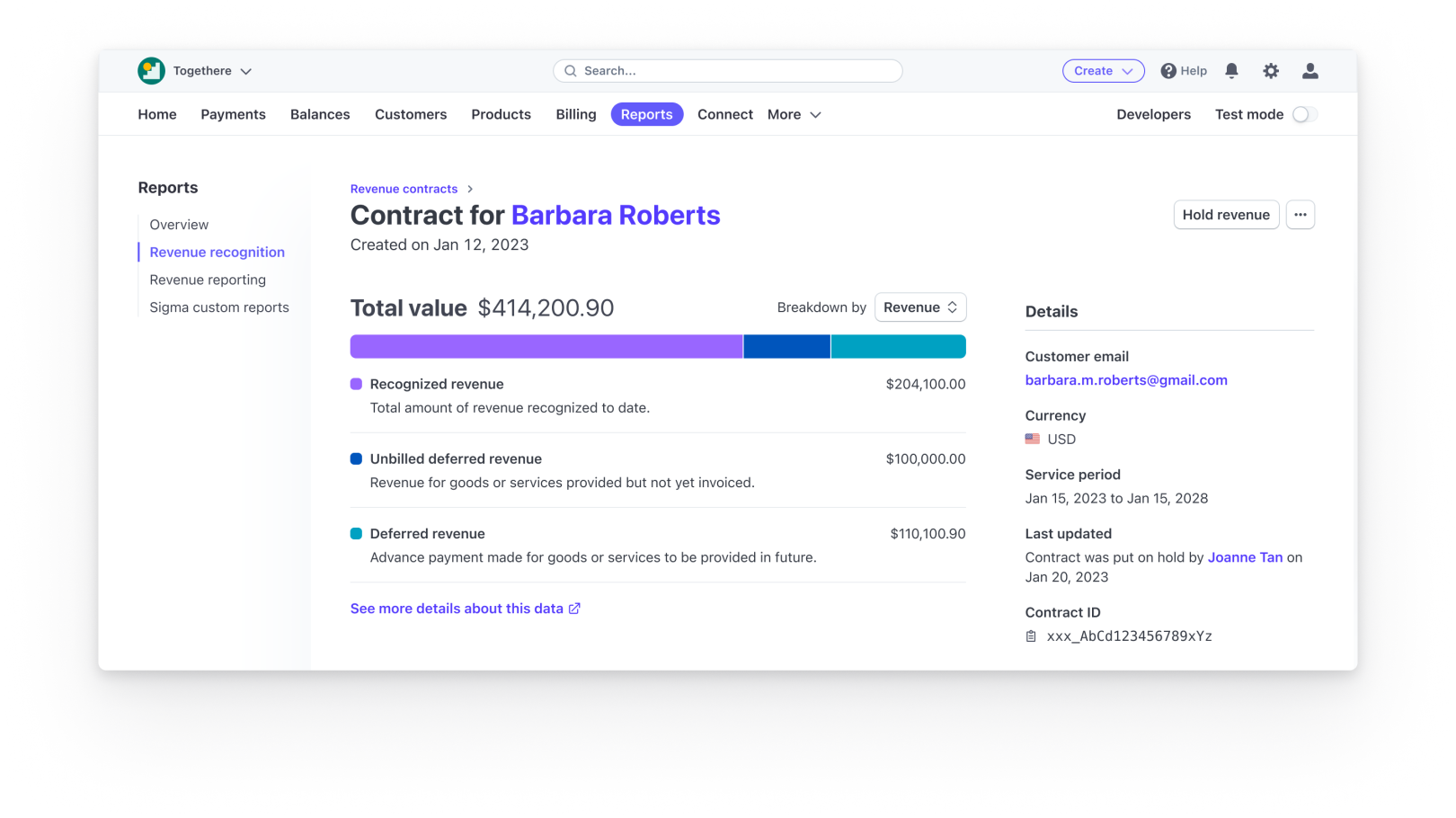

One of the most time-consuming back-office tasks is accurately recognizing revenue across accounting periods. Stripe Revenue Recognition streamlines this process and now has new beta features that help to automate accounting with more precision and customization. You can gain a more complete picture of your revenue by importing and managing revenue contracts (see image below) via the Stripe Billing Connector for Salesforce CPQ. You can also customize your chart of accounts to streamline bookkeeping across systems. Finally, additional platform-based businesses on Stripe Connect can now use Revenue Recognition.

3. Deeper Salesforce integration

Billing, tax, and accounting are so central to any business that workflows can span multiple systems of record, including customer relationship management (CRM) solutions like Salesforce. We’re launching two features that allow businesses to more deeply integrate their Stripe and Salesforce data (bringing our total number of Stripe Connectors with Salesforce to five). The first new feature is Stripe’s Salesforce CPQ Connector, which lets you import and manage revenue contracts to gain a more complete picture of your revenue. The second is the Stripe for Salesforce Platform app, which makes synchronizing your Stripe data easy and lets you create custom flows with Stripe products, including Billing and Tax, within Salesforce.

Businesses are already unlocking value with this new capability. Polygon.io moved seven years of data—nearly one million Stripe events—into a new Salesforce environment in two weeks without any data gaps.

“We no longer worry about syncing issues when it comes to collecting high-quality data and aggregating accurately from different exchanges, and I was able to manage this massive integration without any extra developer support. Because of that, our engineering team was able to focus on rolling out new datasets for our customers that directly helped grow our business,” said Jonathan Cho, developer advocate at Polygon.io.

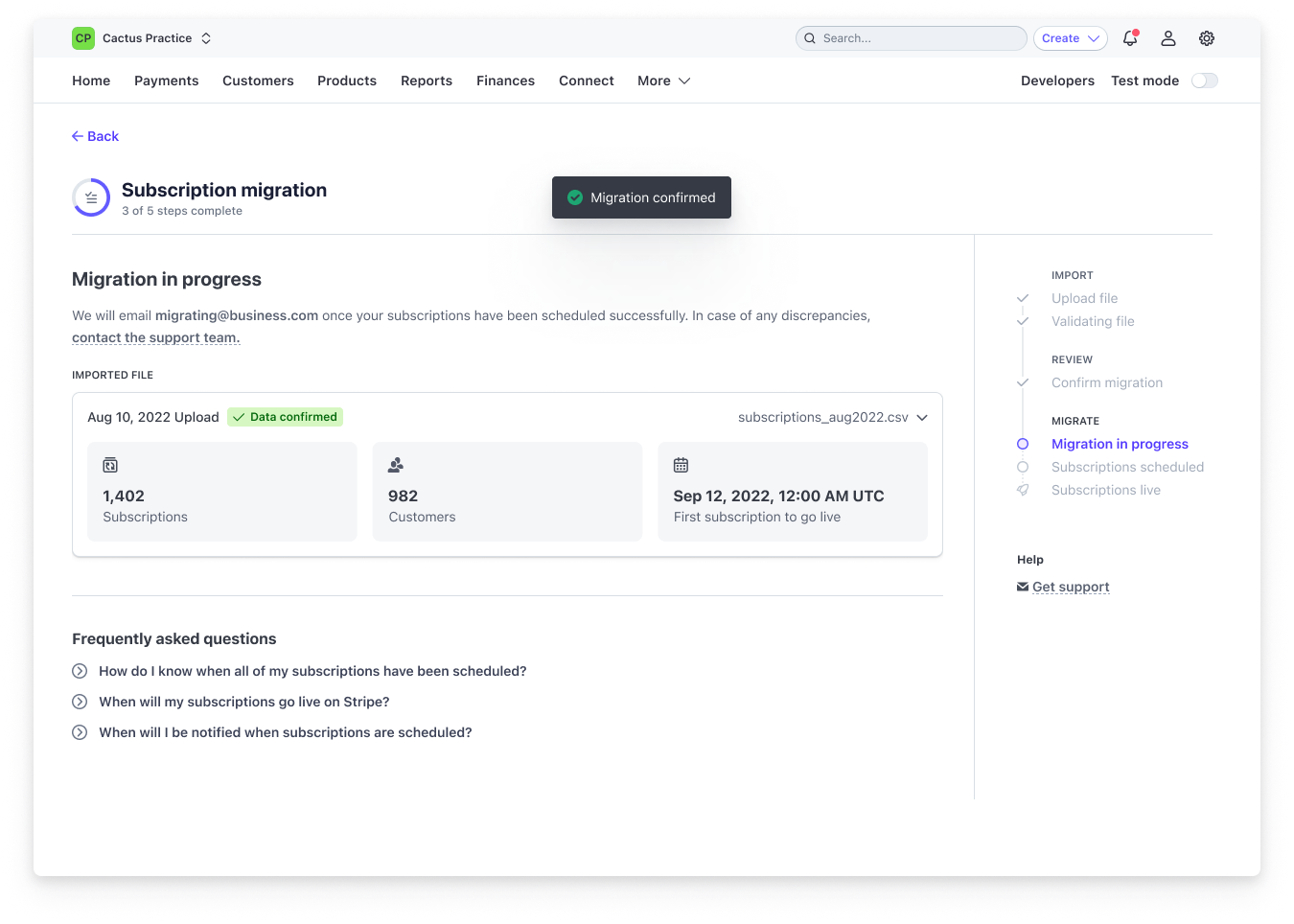

4. Improved Billing migrations

Companies often outgrow their current billing system (whether it’s homegrown or third-party) and end up saddled with overhead and maintenance as a result. They could upgrade billing systems, but that can be even more time- and resource-intensive than maintaining the status quo.

Our Billing migration toolkit solves this dilemma by making it easy to migrate existing subscriptions from a homegrown or third-party system to Stripe Billing. In just a few clicks, you get access to transparent end-to-end migration tracking and avoid heavy lifting and technical overhead, saving you time and resources. You’ll also create a seamless experience for your customers, as we avoid double billing or subscription disruption by maintaining your existing billing cycles. We’ve migrated more than $300 million in subscriptions so far this year.

Altogether, these additions to the revenue and finance automation suite allow finance teams to get more done faster, with fewer software tools to coordinate. CRM provider Keap consolidated more than 20 payment providers with Stripe, then quickly launched Tax in eight weeks, following an unsuccessful six-month attempt with another solution.

“Every three to six months, Stripe has something new and revolutionary for our small business customers, and I know it’s just going to be a couple lines of code for my team to integrate it,” said Danny Diede, product manager and head of payments at Keap.

Tools to improve insights and decision-making

Many users struggle with understanding and analyzing revenue and financial data that’s spread across disconnected systems. Insights that could drive growth end up falling through the cracks. Stripe tools help centralize this data and reduce discrepancies. One way we do this is with Data Pipeline, which is the simplest solution for viewing Stripe data in your data warehouse, where it can be queried in combination with other business information.

We recently expanded Data Pipeline, so that businesses now have the option to view their Stripe data in the warehouse of their choice—including 14 additional Snowflake and Redshift warehouse regions worldwide where businesses can better identify key insights like their best-performing payment methods for a given region. By using Data Pipeline, Lime achieved a 100% reduction in verifying data inaccuracies and a 67% reduction in time to get their data into Snowflake.

A foundation for the future

You can use the entire suite or implement individual products as modular components, depending on your business needs. For example, X (formerly Twitter) and Roblox use Billing and Tax, while OpenAI uses Billing, Tax, and Revenue Recognition.

“Scaling our products means giving our users flexible subscription options. With Stripe Billing, we quickly rolled out monthly and credit-based pay-as-you-go options for ChatGPT and our API, respectively. Not only that, our team benefits from automated tax reporting for month-end thanks to Stripe Tax and Stripe Billing,” said Patricia Lue, head of revenue accounting and operations at OpenAI.

We have many more updates to the revenue and finance automation suite that we are excited to share in the coming months. To learn more about how the revenue and finance automation suite can help your business, please check out the docs, get started now, or get in touch.