For some businesses, PayPal isn’t delivering what they need from a payment processor. The payments app has large fees for chargebacks and doesn’t provide the level of seller protection many businesses are looking for.

Even worse, it doesn’t provide the most frictionless payment experience, which can be a distraction for consumers trying to make a purchase on your site.

Thankfully, there are plenty of PayPal alternatives on the market that businesses can use to send and receive payments efficiently and safely.

But which one is right for your business?

In this article, we’ll outline the top PayPal alternatives that you should take a look at and start using to accept payments from eager shoppers looking to place orders on your site.

Which Payment Processor Is Right for My Business?

In today’s society, consumers are seeking frictionless payment gateways with immediate results.

Payment processors have ushered in a new modern approach to the traditional online transactions to make purchases easier and more accessible.

Basic Features of Payment Processors

Before we get into the specifics of each individual gateway, it’s important to understand what are the basic features offered by most payment processors.

Most payment processors offer:

- Online payment portals or links

- Direct deposit bank transfer

- Mobile payment compatibility

- Currency conversion

- Merchant account dashboards

As you evaluate payment platform options, consider what is most important for your website. There are so many on the market, and a lot of them offer features that overlap.

By understanding what sets each of them apart, you will be able to evaluate and choose the payment provider that’s right for your business.

What Is PayPal’s Biggest Competitor?

Physical cash is the biggest PayPal competitor, according to the company. PayPal is trying to get consumers to perform more cashless, online transactions.

Other companies with large market share like Square, Shopify Payments, and Apple Pay could also be considered direct competitors.

Unlike cash, however, PayPal and other payment gateways make it easy to make transactions on popular ecommerce sites and online marketplaces like eBay.

Can You Sell on eBay Without Using Paypal?

Many consumers think PayPal is required to open a storefront on eBay, but it is not. Credit and debit cards are also accepted on eBay.

Paypal was the popular payment method on eBay in the late 1990s, but since then, the site has allowed more options for consumers to use.

According to eBay,

“When you list an item on eBay, you choose how buyers pay you. In most categories, you must accept either PayPal or credit and debit cards.”

Now, back to the main story: what could be a good PayPal alternative to use?

22 Best PayPal Alternatives

The heavy lifting and research have already been done for you. We’ve compiled a list of the best PayPal alternatives available with the key features and, most importantly, their fees. Browse through them all or click the links below to jump to the specific one you want to review:

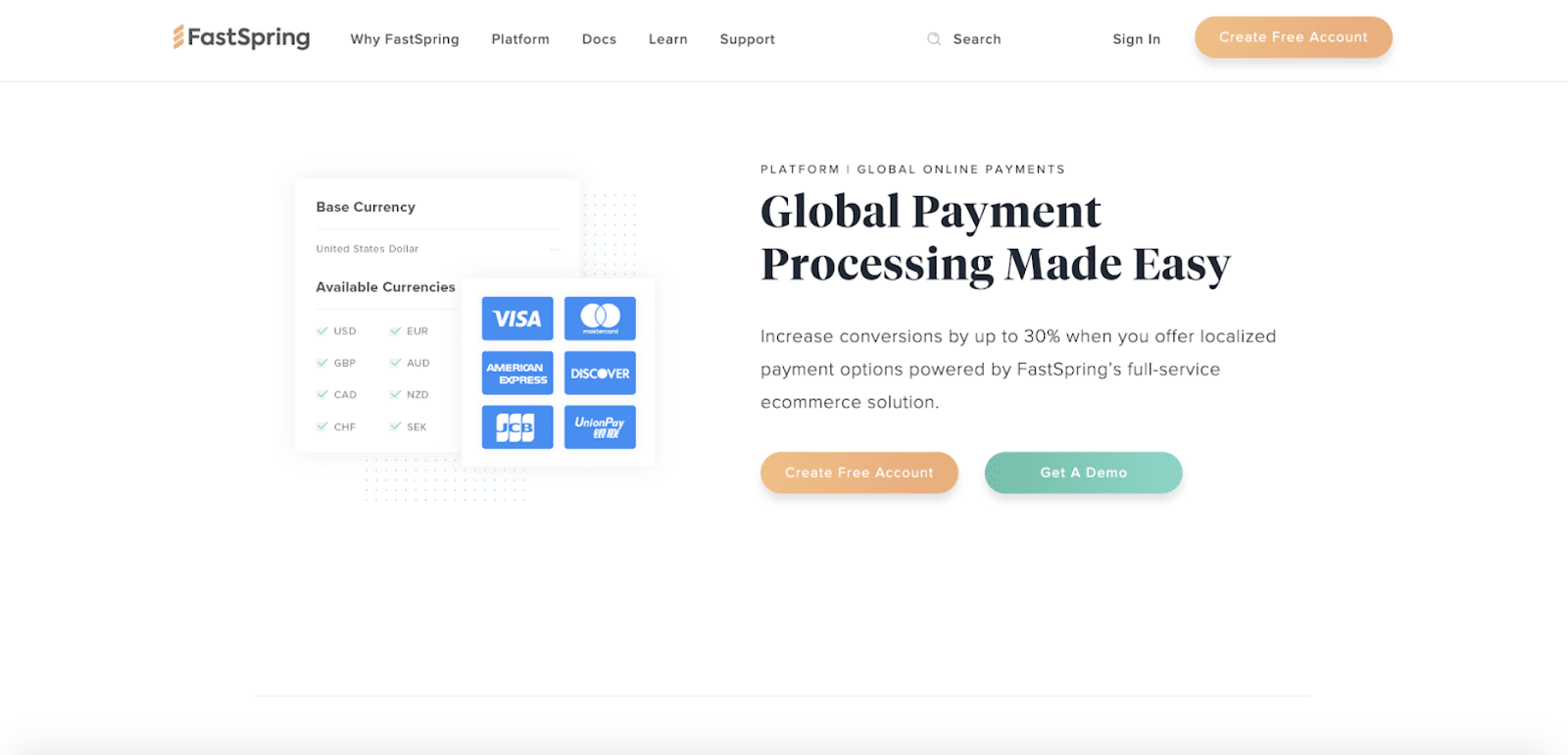

1. FastSpring

FastSpring is an ecommerce payment solution that touts its ability to increase conversions by focusing on localized payment processing.

FastSpring currently accepts over 20 unique currencies through popular payment methods in 15 different languages. The checkout language will automatically update based on the shopper’s location.

In addition, FastSpring is a PCI Level 1 Service Provider—the highest security rating available.

One of FastSpring’s most important features is its ability to process payments more efficiently. Unlike some payment processors, FastSpring will reroute transactions automatically to other participating banks and try the transaction again if the first one fails.

FastSpring offers both a fixed fee model with 8.9% flat fee per transaction or a variable model that adds a fee based on 5.9% of the total transaction + $0.95.

2. Amazon Pay

Amazon Pay streamlines payments by enabling Amazon account holders to seamlessly check out on your site. Payments that are processed through Amazon Pay are granted the “A to Z Guarantee”, ensuring optimal delivery and condition of your purchases.

Since Amazon Pay requires consumers to have an Amazon account, customers are verified before buying. This process, along with its fraud detection services, helps decrease the number of issues you’ll have at checkout.

Amazon Pay is known for its one-click ordering interface, making its ease-of-use a competitive advantage.

Amazon Pay charges 2.9% + $0.30 for each domestic US transaction.

3. Stripe

Stripe considers itself the “payments infrastructure for the internet.” Companies of all sizes use Stripe to manage transactions and make payments with ease. Stripe’s explosive revenue and growing market share puts it in the number 2 position, following only Paypal.

Stripe offers a lot of flexibility for business owners. They can integrate Stripe into their storefront and accept global transactions by adding only one integration to their site. Some competitors require multiple integrations for each country you want to do business in. All processing takes place on a local level and card numbers and keys are encrypted and stored separately for security.

Stripe is a comprehensive platform for every aspect of the payment process. Business owners can customize customer payment experiences, evaluate optimization opportunities, review fraud alerts, reconcile vendors, and execute reports.

Stripe offers numerous integrations, including ones with QuickBooks and NetSuite, to connect your payment method directly to your accounting ledger.

Stripe charges 2.9% + $0.30 per transaction. Make sure to read our Stripe vs PayPal in-depth comparison.

4. Google Pay

Google Pay is a contactless payment method that’s used by millions of stores around the world. The processor uses an encrypted number for customers in place of their credit card number. This increases security and opens up a handful of new ways to conduct transactions.

Consumers can send and receive money via email address or phone number. Businesses can use Google Pay as another way for customers to check out in their online store.

Plus, businesses can take advantage of Google Pay’s integration with the Passes app. This enables them to promote loyalty programs, offers, gift cards directly in the Passes app. They can also target consumers with location-based notifications.

Google Pay doesn’t charge any merchant fees but does charge standard credit card fees.

5. WePay

WePay processes payments for businesses and integrates with many of the software programs they are already using. Chase Bank acquired WePay in 2017.

WePay offers businesses same-day deposits and the ability to integrate payment information with other reports you are currently running.

WePay can be easily added to your site with just a few lines of code. In addition, businesses can use its physical terminals and mobile card readers for in-person payments.

WePay offers business safeguards including loss protection and contractor management features for your employee payroll.

WePay charges 2.9% + $0.30 per transaction.

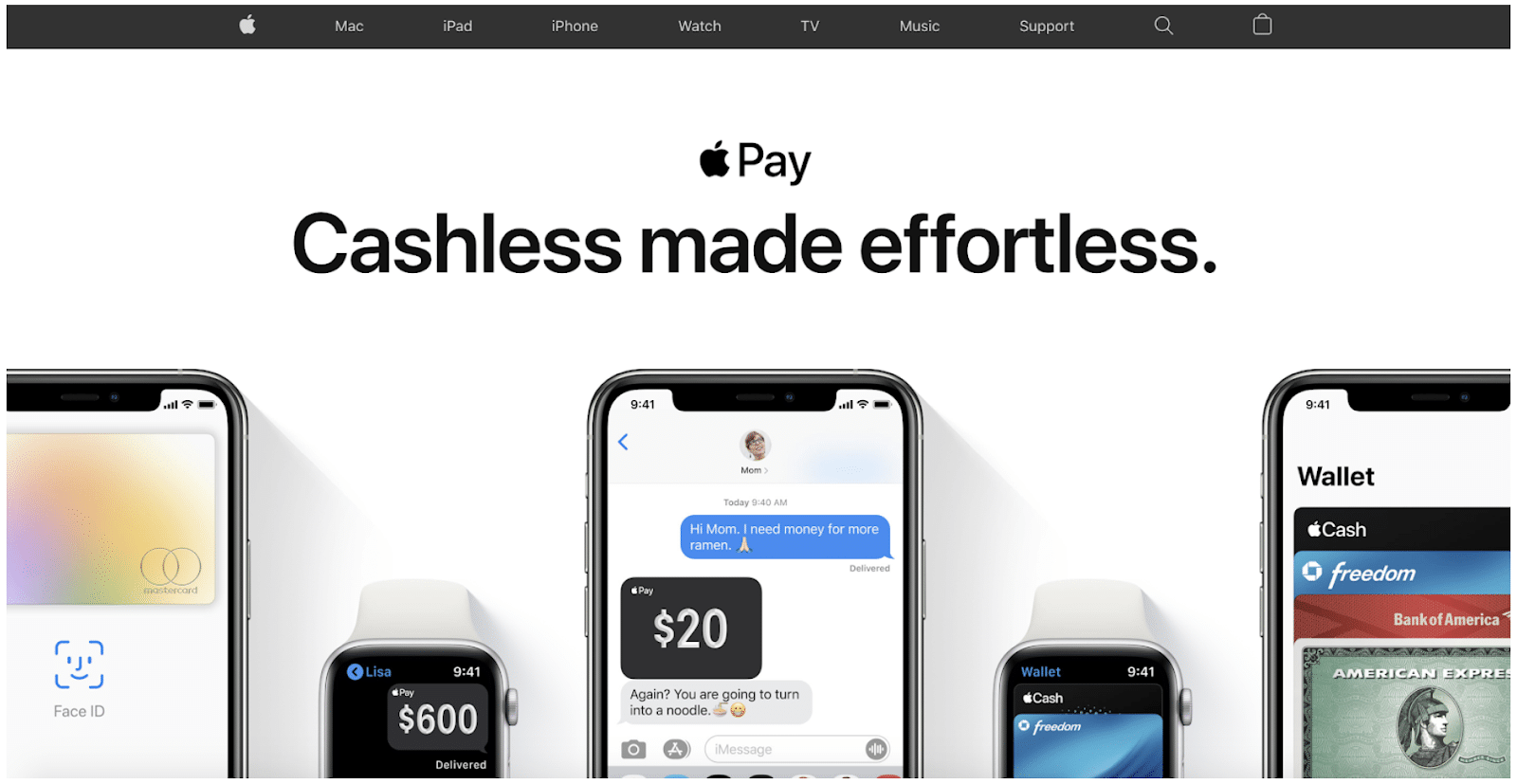

6. Apple Pay

Apple Pay enables businesses to collect cashless payments from customers who have an Apple device. In addition to purchasing items with Apple Pay, users can send and receive money, making this a near-ubiquitous way to execute your transactions.

Apple Pay is intuitive for users. They can pay online in merely one click or pay with their iPhone or Apple watch in your store. It’s compatible with Touch ID on a Mac, increasing the ease and efficiency of their purchase.

Businesses can run transactions exclusively through Apple Pay or they can use it in conjunction with other payment types. In addition, merchants can enable their rewards program to use and populate directly through Apple Pay.

Apple Pay is compatible with most card issuers and payment providers. There is no fee passed on to businesses.

7. 2Checkout

2Checkout is a “monetization platform” that makes it easier to send and accept payments from customers, suppliers, and vendors all around the world.

2Checkout offers subscription billing, shopping cart templates, custom checkout fields, and integrations with major ecommerce platforms like Shopify and alternatives like BigCommerce.

The processor also offers financial and tax support, including the ability to manage sales tax in the United States. It can even calculate and pay your taxes for you.

With its international processing capability, 2Checkout provides guidance to ensure you’re adhering to finance regulations and laws in various countries.

2Checkout charges 3.5% + $0.35 per transaction.

8. Authorize.Net

Authorize.Net processes payments online, on mobile, and in-stores to ensure every customer can purchase without friction. Visa acquired Authorize.Net in 2010.

Authorize.Net focuses on the ease of the transaction for the consumer. It offers a simple, customizable “Buy Now” button for one-time payments.

Authorize.Net accepts a variety of payment options, including debit cards, credit cards, and digital payments.

It provides fraud filters, allowing businesses to set certain rules (i.e. limiting the number of transactions, shipping vs. billing address inconsistencies, etc.) that will flag an order for review.

In addition, it offers customizable invoicing templates with automatic reminders that can be triggered after a certain amount of time or specific event.

Authorize.Net charges $25/month + 2.9% + $0.30 per transaction.

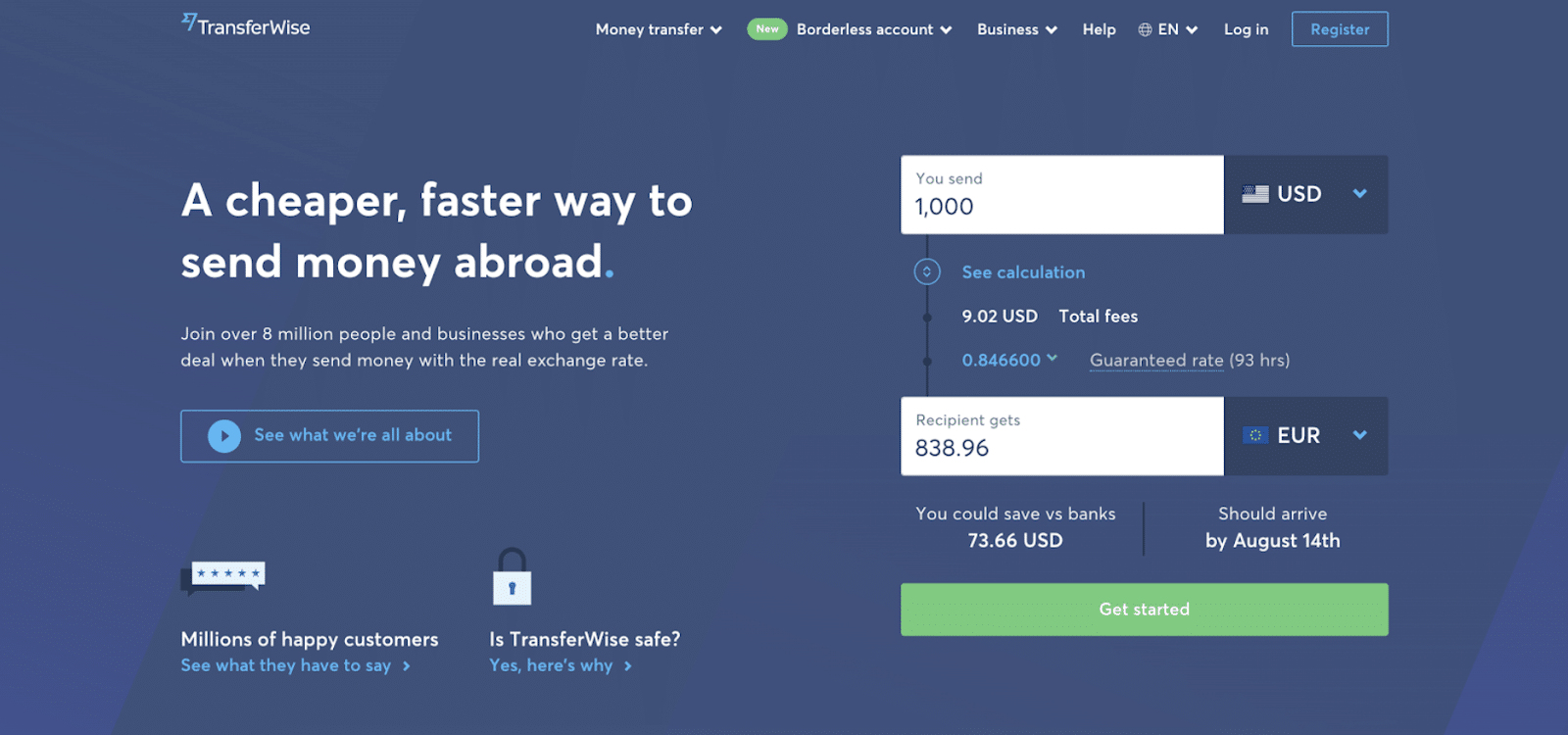

9. TransferWise

TransferWise is a payment service that prides itself on offering the real exchange rate for currencies across country lines.

TransferWise’s core competitive advantage is its ability to calculate a real, current exchange rate. In most cases, this has been up to 19X cheaper than the one offered by PayPal.

TransferWise also offers a handful of features including the ability for merchants to pay/send invoices automatically and receive money with no fees attached.

The processor integrates with Xero accounting software for easy bookkeeping as well as a handful of other software.

TransferWise for Business charges a $31 set-up fee + $1.40 Transaction Fee + Currency Exchange Fee

10. Payline

Payline offers flexible payment solutions for in-person, online, and mobile payments.

Some of Payline’s most popular features include its custom invoicing, recurring billing features, ACH payments, and custom payment pages.

It integrates with a handful of point of sale (POS) systems, Shopping Carts, QuickBooks, and card readers. Payline doesn’t charge any cancelation fees, and its transaction fees are lower than PayPal.

Payline charges $10/month for its virtual terminal + 2.25% transaction fee.

11. Square

Square is a payment processor that enables businesses to accept payments in multiple forms through their secure gateways.

Square enables businesses to auto-bill customers and can easily pull existing customers’ stored information for accelerated purchases.

Square has hardware options available for seamless in-person transactions. Consumers check out by transacting online, swiping or tapping a Square reader, or using a key-in payment device.

Square charges 2.65% per card transaction and 2.9% + $0.30 per online transaction. Make sure to check out our Stripe vs Square comparison.

12. QuickBooks Payments by Intuit

QuickBooks Payments facilitates transactions between you and your vendors or customers to ensure you’re getting paid what you deserve. If you’re already using QuickBooks for your accounting and do mostly invoicing, this is a good option for you.

QuickBooks Payments accepts credit cards, debit cards, and ACH bank transfers.

Payments can be processed online, through mobile, and using card readers. Once the money hits your bank account, you’ll be able to spend it or take it out of an ATM almost immediately.

QuickBooks Payments charges 2.4% + $0.25 per transaction.

13. Dwolla

Dwolla is a fully customizable payment processor that can be easily integrated into your current storefront and business.

Dwolla considers itself “bank agnostic,” meaning it is able to work with any bank that you use.

Dwolla uses tokenization (a type of encryption) to eliminate data concerns and offers mass payment options to multiple sources.

Customers that sign up for Dwolla control how much information they provide, which classifies them into different customer types to ensure security.

Dwolla charges.5% per transaction (min. 5¢, max. $5) or $2,000/month flat monthly pricing.

14. Shopify Payments

Shopify Payments is the payment processing gateway for one of the world’s leading ecommerce platforms.

Shopify Payments focuses on simplicity. The company’s positioning says it all, “Go from setup to selling in one click.”

Shopify Payments works with all the commonly used payment methods and local currencies. The platform is trusted by hundreds of thousands of businesses and offers 3D secure checkouts.

If you’re already using Shopify as your ecommerce platform, you can track orders and process payments under one roof.

Shopify Payments charges $29/mo + 2.9% + $0.30 per transaction.

15. Adyen

Adyen is a payment platform that values growth, revenue, and real partnership with its merchants. Adyen offers language and currency recognition for customers all around the world, making it easy for them to buy from your store.

In addition, Adyen offers a unique customer experience that’s able to recognize frequent customers at checkout.

With the purchasing data, Adyen creates shopper profiles to uncover rich insights about your customers.

Adyen charges 3.95% + $0.12 per transaction.

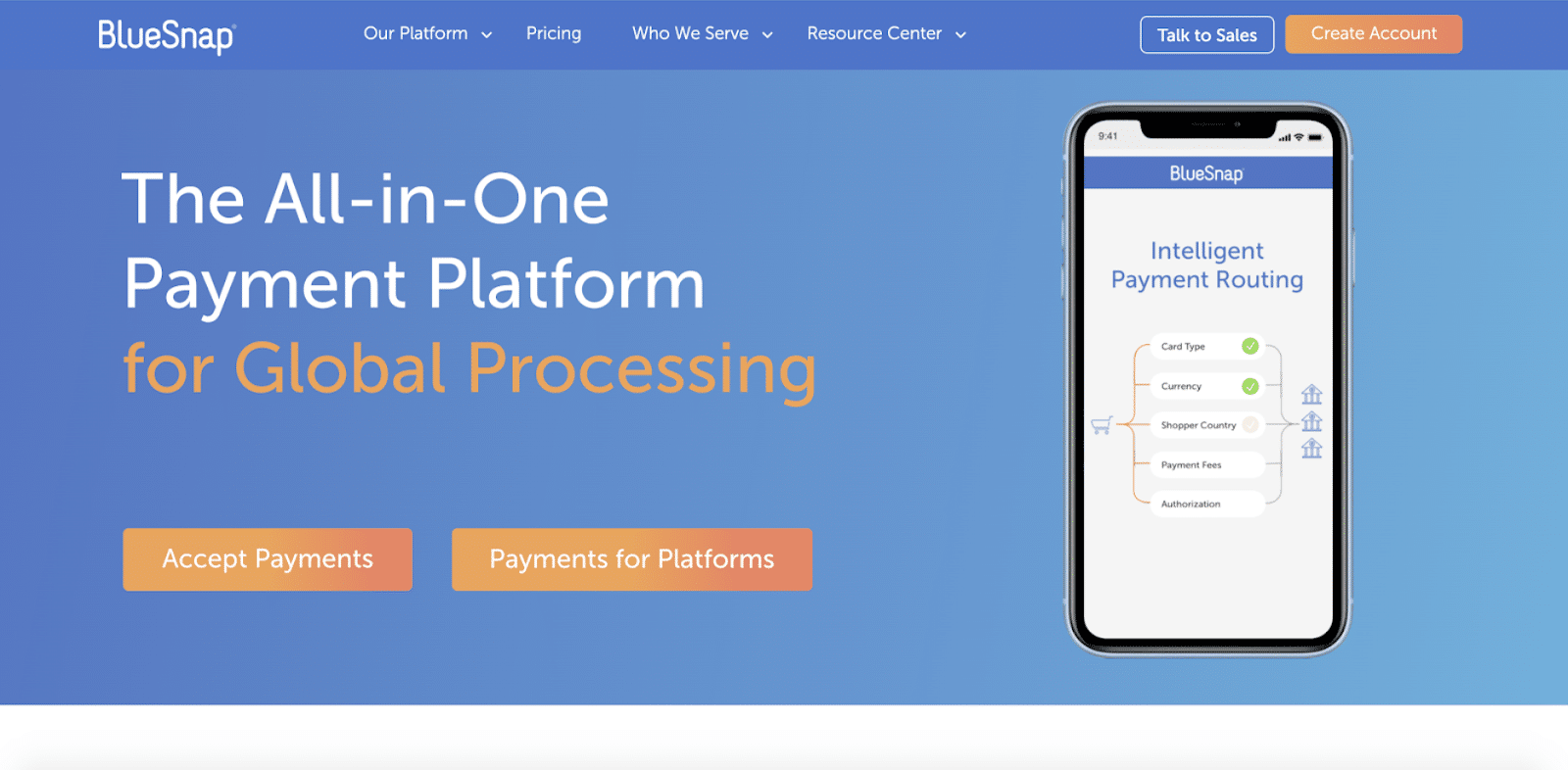

16. BlueSnap

BlueSnap provides global processing for leading businesses such as Monday.com, Namely, BlueJeans, OutBrain, Wheels Up, and more.

BlueSnap uses “intelligent payment routing” to improve the success of its transactions. This is achieved through its partnership with 30+ global banks, which take the local transactions.

BlueSnap accepts 100+ shopper currencies and settles in 17+ currencies. In addition, the company is rated in the highest security class.

The processor integrates with QuickBooks, Xero, and Salesforce, so you can automate accounts receivable and other business transactions.

BlueSnap charges 2.9% + $0.30 per transaction.

17. GoCardless

GoCardless imagines life without the need for a tangible credit card with its payment processor made for recurring and one-off payments. GoCardless is great for recurring transactions that debit directly from your accounts.

The processor supports subscription and invoice payments as its sweet spot with integrations for Zuora and Xero.

With GoCardless’ own integration, you can collect payments across 30+ countries.

They’re reliable too. Their Success+ payment retries feature figures out the day and time to run the transaction on when it’s most likely to succeed. This has reduced payment fail rate on average by 15%.

GoCardless charges 1-2% + $0.25 per transaction.

18. Thryv

Thryv helps small businesses get paid faster with a seamless transaction experience and speedy payment processing. Over 350,000 small businesses use it.

With Thryv, you can send interactive estimates, invoices, and reminders. You can even scan credit cards on your smartphone.

Thryv offers secure payment processing. One drawback is that it doesn’t have many integrations. Instead, Thryv relies on Zapier to connect to other software. It has a handful of other products that can work alongside its payment processor, including a marketing and customer review platform.

Thryv charges 2.6% + $0.30 per transaction.

19. PaySimple

PaySimple doesn’t have all the bells and whistles as some of the other payment processors, but it still gets the job done with a relatively low transaction fee.

With PaySimple, you can collect registrations with online payment forms, set up recurring billing, and send invoices.

PaySimple has cash flow management reporting to track payments received. For the ones you haven’t received yet, you can set up automatic notifications that will trigger on their own, so you don’t have to chase invoices.

PaySimple charges 2.49% per transaction + a monthly fee.

20. Opayo (formerly SagePay)

Opayo, formerly known as Sage Pay, is an online payment processor that’s run by its parent company, Elavon. Opayo offers invoice, face-to-face, online, and phone payments for businesses.

The processor integrates with Elavon Financial Services DAC Accounting software and has fraud screening tools in place to ensure secure transactions.

Opayo makes it easy for your customers to purchase with a single click checkout for invoices and online payments.

Opayo charges a monthly fee of $35/month.

21. Payoneer

Payoneer focuses on the ease of sending and receiving global payments. Their tagline is “Your passport to global growth.”

Payoneer allows you to pay suppliers for free with immediate in-network payments. In one click and two hours, your money will be transmitted.

Payoneer accepts multiple currencies to provide international payment options. In addition, it has an Amazon Store Manager feature that compiles all your Amazon transaction data across multiple storefronts, making it easy to see how much revenue you have.

Payoneer charges up to 3% for credit cards or 1% on USD ACH Bank Debit.

22. Bolt

Bolt works seamlessly with your business with the help of a countless number of integrations with leading platforms and credit cards. It bolsters your security with a micro-authorization and human review fraud protection.

In addition, you get 100% coverage on fraud chargebacks, making it even safer for your company to transact.

Bolt is ahead of the curve and accepts a variety of payments — everything from digital wallets to installment payments.

Bolt charges a monthly fee that starts at $16/month.

Choosing the Right PayPal Alternative

As you can see, there are plenty of PayPal alternatives to choose from. While each platform has pros and cons, these are a few that stood out.

Best PayPal Alternative for International Payments

Give Stripe, 2Checkout, and BlueSnap another look if you’re anticipating international transactions.

Best PayPal Alternative for Security

Most of the platforms passed the basic test for security. From our research, FastSpring, Shopify Payments, and Bolt stood out for the security measures they have in place.

Best PayPal Alternative for Low Fees

Payline touted a 2.25% fee structure, which is lower than the 2.9% average. Depending on your order volumes, which could change dramatically over the holiday season, you could also take a look at a payment platform like FastSpring that offers fixed pricing.

Summary

Is PayPal the most famous payment gateway out there? We’d say yes. Is it the best one? Probably no, as there are so many use cases and needs within the business world that a single tool would hardly address all. Thankfully, there are solid PayPal alternatives to look at.

If you’re not happy with it, now it’s the time to start considering switching from PayPal to a different payment app that might work better for your online business. In doing so, you will likely have better fees, more features, and safer transactions with your customers.

Once you’ve made the transition, make sure to get back here share your experience in the comments section!

Leave a Reply