What is DeFi?

Have you ever heard about defi before? Are defi apps the ultimate killer apps in the crypto space or just new hype? No matter if you never heard about defi before or you want to make sure you understand it right this article is for you.

DeFi or decentralized finance is a movement that aims at making a new financial system that is open to everyone and doesn’t require trusting intermediaries like banks. To achieve that defi relies heavily on cryptography, blockchain and smart contracts.

Smart contracts are the main building blocks of defi. If you don’t know what smart contracts are or you want to refresh your knowledge you can check out my previous blog post.

It’s worth noticing that currently most if not pretty much all of the defi projects are built on Ethereum. The main reason for this is the Ethereum’s fairly robust programming language called Solidity that allows for writing advanced smart contracts that can contain all the necessary logic for the defi applications, besides that Ethereum has the most developed ecosystem across all the smart contract platforms with thousands of developers building new applications every day and the most value locked in smart contracts which create an additional network effect. In fact, all the defi protocols mentioned in this article are built on Ethereum.

Now, let’s see how it all started.

Quick History of DeFi

One of the first projects that started the decentralized finance movement was MakerDAO.

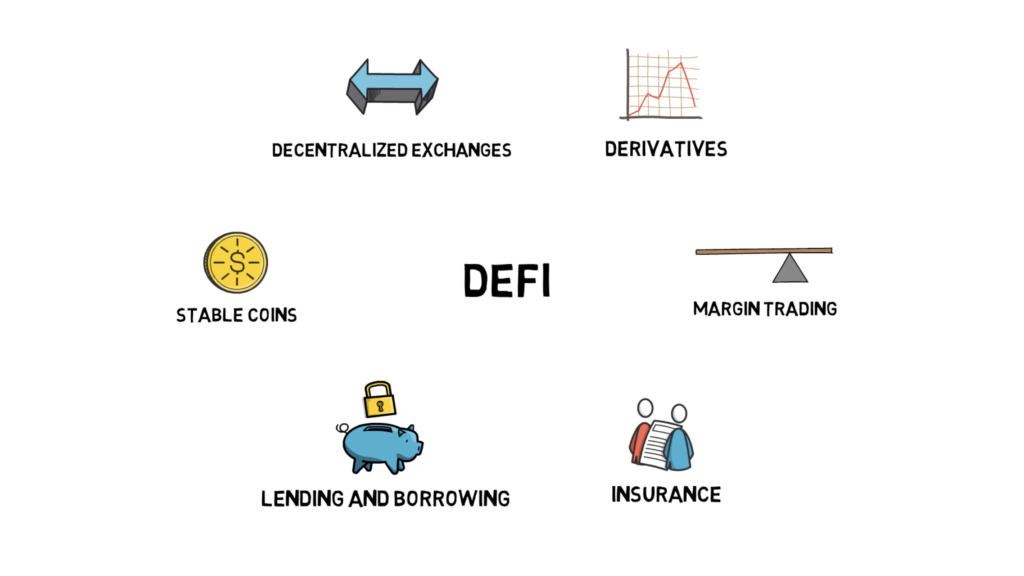

MakerDAO, founded in 2015, allows user to lock in collateral such ETH and generate DAI – a stable coin that by using certain incentives follows the price of US Dollar. DAI can be also used for saving on Maker’s Oasis platform. This recreates one of the pillars of the financial system – lending and borrowing. In fact, defi is trying to create the whole new financial ecosystem in a permissionless and open way. Lending and borrowing is only one part of this ecosystem. Some of the other important parts are stable coins, decentralized exchanges, derivatives, margin trading and insurance.

Let’s talk about each of the categories one by one.

Lending and Borrowing

Besides MakerDAO that we just mentioned there are a few other important defi projects in this category.

The main one is Compound. Compound at the time of creating this article is the biggest defi project in the lending category with ~$630M worth of assets locked in the protocol.

Compound is an algorithmic, autonomous interest rate protocol that allows users to supply assets like Ether, BAT, 0x or Tether and start making interest. Supplied assets can also act as collateral for borrowing other assets.

Another popular defi project in this category is Aave.

Algorithmic Stable Coin

With clever use of smart contracts and certain incentives we can create a stable coin that is pegged to the US Dollar without having to store dollars in the real world. We already mentioned MakerDAO that essentially allows the users to lock in their collateral and generate DAI. DAI is a good example of an algorithmic stable coin.

Besides DAI, there are multiple other non-algorithmic stable coins like USDT, USDC or PAX. The main problem with them is the fact that they’re centralized as there is a company behind them that is responsible for holding the equivalent of the value of stable coins in USD or other assets. Nevertheless, these stable coins gained a lot of popularity and are extensively used in defi applications like Compound or Aave.

Decentralized Exchanges

Decentralized exchanges or dexes, in opposite to standard, centralized crypto exchanges, allow for exchanging crypto assets in a completely decentralized and permissionless way without giving up the custody of the coins. There are 2 main types of dexes the liquidity pool based and the order book based ones.

A few examples of the liquidity pool based ones are Uniswap, Kyber, Balancer or Bancor. Loopring and IDEX are examples of the order book based ones.

Derivatives

Similarly to traditional finance, derivatives are contracts that derive their value from the performance of an underlying asset.

The main defi application in this space is Synthetics which is a decentralized platform that provides on-chain exposure to different assets.

Margin Trading

Margin trading also similarily to traditional finance is the practice of using borrowed funds to increase a position in a certain asset.

The main defi apps in the margin trading space are dYdX and Fulcrum.

Insurance

Insurance is yet another part of traditional finance that can be reproduced in decentralized finance. It provides certain guarantees of compensation in return for a payment of a premium. One of the most popular applications of insurance in the defi space is protection against smart contract failures or protection of deposits.

The most popular defi projects in this space are Nexus Mutual and Opyn.

Oracles

Another really important although not strictly limited to finance part of the defi ecosystem are oracle services that focus on delivering reliable data feeds from the outside world into the smart contracts. The most popular project in this space is Chainlink.

These are pretty much all the main parts of the defi ecosystem. They can also be combined together in multiple various ways. We can think about them as “money Legos” as more complicated defi projects can be built on top of the existing blocks.

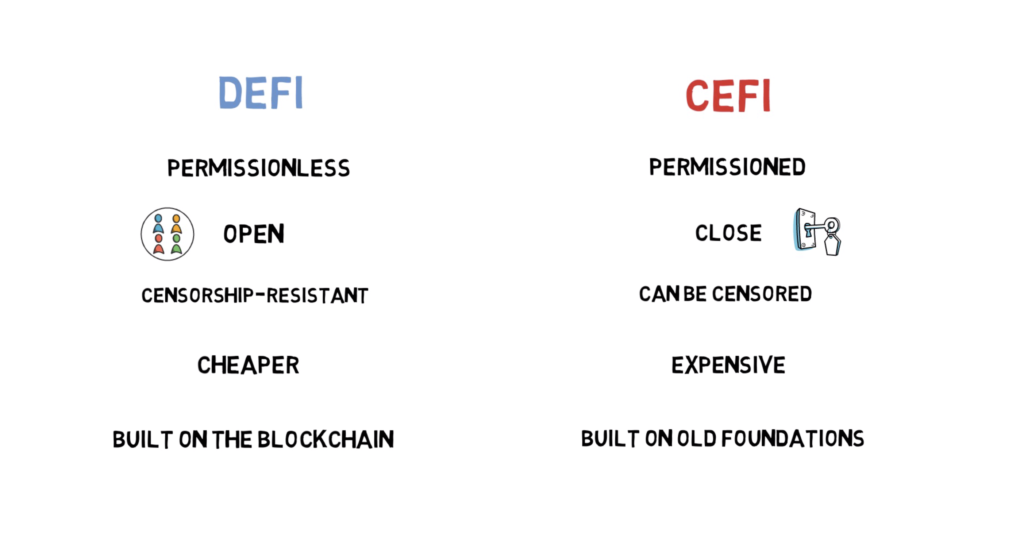

DeFi vs CeFI

Let’s compare the main differences between defi and cefi that stand for centralized or traditional finance.

What are the risks?

Before we wrap up this article we have to also mention the potential risks associated with defi.

One of the main risks are bugs in smart contracts and protocol changes that can affect the existing contracts. We described them in more details in the previous post about smart contracts. This is also when users can take additional insurance to lower the risk of potential issues.

Besides that, we always have to check how decentralized a defi project really is and what is the shutdown procedure if something goes wrong. Does someone have an admin key that can be used to shutdown the protocol? Or maybe there is some on-chain governance in place to make such a decision.

On top of that, we have to always account for the more systemic risk that can be caused by for example asset prices sharply losing their value which may result in a cascade of liquidations across multiple defi protocols.

Network fees and congestion can also be a problem, especially if we want to avoid liquidations and we’re trying to let’s say supply more collateral on time. Upcoming Ethereum 2.0 and second layer scaling solution can help to solve this problem.

There is also a set of more subtle features or changes that applied to one of the protocols may incentivise users to certain non-obvious actions that can cascade across multiple protocols. A good example of something like that would be a recent distribution of COMP tokens in the Compound protocol that caused users to get into seem to be non-profitable high-interest borrowing that was actually profitable due to being rewarded in the additional COMP tokens. Even though situations like that can be quite dangerous they make the whole ecosystem stronger and less vulnerable to similar situations in the future.

Summary and the future of DeFi

As you probably already noticed, defi is a super interesting and vibrant space that is full of opportunities. Although, we have to remember that is is still a very nascent industry, so it’s a high risk and a high reward game.

Defi is the closest thing that can actually disrupt the traditional financial industry. In opposite to most of the fintech companies defi is built on the new rails instead of relying on the outdated technologies and procedures.

Currently, most of the financial products can be only created by banks. Defi is open, permissionless and enables cooperative work in a similar way to the Internet.

Although defi is currently built predominantly on Ethereum, with more adoption of interoperability protocols we may see more projects being built on different chains in the future.

Extra

This was only an introduction to defi. In the following articles we’ll be focusing on each part of the defi ecosystem separately, so stay tuned.