If we tax fossil fuels – making them more expensive – then the awesome power and creativity of the free market will create diverse alternatives and efficiencies with minimal additional government intervention. We will ultimately save money, be healthier, and slow the irreversible transformation of our climate.

Every year we extract billions of tons of hydrocarbons from the ground and from forests and burn them. Not surprisingly this has added  hundreds of billions of tons of CO2 to the atmosphere and the oceans. CO2 in the atmosphere traps heat, and CO2 in the oceans makes them more acidic. Because of all this the glaciers and icecaps are melting, temperatures and ocean levels are rising, and corals are dying. Exxon’s scientists warned about this in 1982, but like other oil companies has continued funding climate-change denial. When the situation is bad enough to lead Bill Nye to drop the f-bomb then maybe we should pay attention.

hundreds of billions of tons of CO2 to the atmosphere and the oceans. CO2 in the atmosphere traps heat, and CO2 in the oceans makes them more acidic. Because of all this the glaciers and icecaps are melting, temperatures and ocean levels are rising, and corals are dying. Exxon’s scientists warned about this in 1982, but like other oil companies has continued funding climate-change denial. When the situation is bad enough to lead Bill Nye to drop the f-bomb then maybe we should pay attention.

Hydrocarbons are a dense and cheap source of energy. These convenient attributes gives individuals strong incentives to use hydrocarbons, but when seven billion people do the convenient thing the consequences are disastrous. It is a classic tragedy of the commons.

When doing the wrong thing is individually beneficial but collectively disastrous, and invoking Kant isn’t working, then we either need to prohibit the problematic action, or tax it. Prohibiting fossil fuels is impractical, but taxing them can encourage efficiency and alternatives, get people to pay the real costs, and lead us to a more sustainable future. Taxing fossil fuels is the fairest way to ensure that those who consume the most fossil fuels pay the most for the damage which these fuels cause, and can help finance a weaning off of them.

I didn’t think I’d have to say it, but apparently I do. Human-caused increases in atmospheric CO2 are real and they are causing global warming and other problems. If you want to debate that then you need to go somewhere else. This post is for debating what to do about it. Comments that deny the scientific reality will be deleted. My blog, my rules.

Proposal

The best way to encourage humans to use less fossil fuel is to tax the extraction or burning of carbon, as soon as possible, with a commitment to gradually raising the tax.

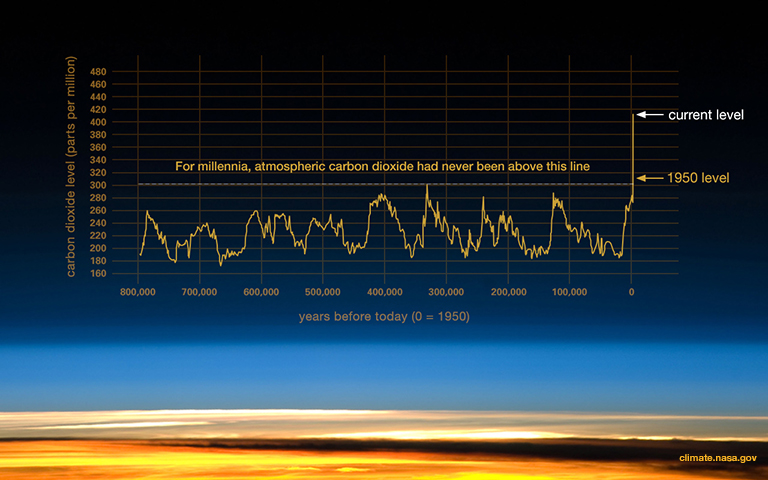

If the graph below doesn’t alarm you then you need to look at it more closely:

Every day we make little decisions that affect how much energy we use. We can set the air conditioner to 74 degrees, or raise it to 76. We can walk, drive, carpool, or drive alone. We can decide whether to buy solar panels, whether to buy a Prius or a Suburban, where to live, and whether to insulate the attic. All of these choices affect how much energy is consumed, and therefore how much carbon is emitted, and all of these choices are affected, to some extent, by the cost of energy. If energy is more expensive then we will naturally be more careful in how we use it.

In particular, if consumers knew that fossil fuels were going to continue to get more expensive then they would demand more efficient cars, turn off some outdoor lights, buy LEDs, and turn down the heat when not at home. In some cases these choices – choosing an efficient car instead of a gas guzzler for example – will actually save money.

Gasoline where I live currently costs about US $3 a (US) gallon. Gasoline is not the only fossil fuel that would need to be taxed but it is probably the one for which we have the most intuitive pricing sense. I think that we need to do something like an immediate $0.25/gallon tax on gasoline (overdue, since the US federal gas tax was last increased in 1993), with a promise that this tax would go up by an additional $0.25/gallon every six months for several years. After 5.5 years and twelve bumps, the price of gas would double; if the increases continued for the subsequent twelve years, the price would double again. Proportionate increases would be needed for coal, natural gas, and other uses of petroleum, and care would need to be taken to avoid penalizing the poor (more on this later).

Gasoline where I live currently costs about US $3 a (US) gallon. Gasoline is not the only fossil fuel that would need to be taxed but it is probably the one for which we have the most intuitive pricing sense. I think that we need to do something like an immediate $0.25/gallon tax on gasoline (overdue, since the US federal gas tax was last increased in 1993), with a promise that this tax would go up by an additional $0.25/gallon every six months for several years. After 5.5 years and twelve bumps, the price of gas would double; if the increases continued for the subsequent twelve years, the price would double again. Proportionate increases would be needed for coal, natural gas, and other uses of petroleum, and care would need to be taken to avoid penalizing the poor (more on this later).

A US gallon of gas (6.3 pounds) generates about 20 pounds of CO2 when burned, so 100 gallons generate one ton of CO2. Therefore a $0.25 tax on a gallon of gasoline is equivalent to a tax of $25/ton of CO2.

I’m not claiming that this is the magically correct tax amount – it’s higher than most proposals – but I think that it is thematically correct and necessary. That is, while the initial increase should be fairly modest, there needs to be a promise of future increases so that consumers and governments can plan and invest appropriately. Maybe the $0.25 increase should be yearly to give people more time to adjust, or maybe there needs to be a bigger initial boost to pay for efficiency improvements. The important thing is to start taxing carbon, and keep increasing the tax.

A carbon tax can easily be designed to be revenue neutral. It could, if desired, be designed so that all of the tax revenue is returned to residents as a per-capita rebate. The average rebate would exactly match the average amount paid, and those who used less fossil fuel or made changes to improve efficiency would come out ahead – their rebate would be greater than the carbon tax that they paid, subsidized by those who consume more.

Some of the carbon tax could be earmarked for helping consumers reduce their energy usage. This could include improving public transit, reducing transit fares, subsidizing electric bicycles, rebates for home insulation, etc. These rebates would help consumers adjust to a world where energy is not implausibly cheap, and could actually leave some people with lower power bills. Currently we subsidize cars by providing free parking and roads (no, the federal gas tax doesn’t pay for all this) – which leads to congestion and parking shortages. We would be wiser to subsidize things that reduce congestion and pollution instead.

Some of the carbon tax could be earmarked for helping consumers reduce their energy usage. This could include improving public transit, reducing transit fares, subsidizing electric bicycles, rebates for home insulation, etc. These rebates would help consumers adjust to a world where energy is not implausibly cheap, and could actually leave some people with lower power bills. Currently we subsidize cars by providing free parking and roads (no, the federal gas tax doesn’t pay for all this) – which leads to congestion and parking shortages. We would be wiser to subsidize things that reduce congestion and pollution instead.

Many proposals on how to use carbon tax revenue have been made – see here for an example.

While some may argue that a carbon tax is expensive, the alternative is to continue irreversibly damaging the climate and flooding coastal cities, which will end up costing more, paid mostly by our children and grand-children.

But, carbon taxes are too expensive!

A carbon tax would, by design, increase the cost of fossil-fuel intensive activities. However, there is no reason for it to make the cost of living higher, and over the long run it would actually save trillions of dollars.

A carbon tax would, by design, increase the cost of fossil-fuel intensive activities. However, there is no reason for it to make the cost of living higher, and over the long run it would actually save trillions of dollars.

When gas prices suddenly go up by a dollar a gallon then the US economy frequently dips into a recession. It is natural to worry that a carbon tax would have the same effect. It won’t. The reason a price spike hurts the economy is because it takes billions of dollars from consumers and small businesses and sends it to OPEC, or to the profits of huge multinational oil corporations. A tax keeps the money where it can be returned to consumers or put to productive use.

But, carbon taxes are regressive!

The wealthy are the most responsible for climate change, but the poor bear the majority of the costs. It is critical that we not repeat this injustice when we create a carbon tax to slow down climate change.

Rich people burn more carbon than poor people, but poor people typically spend a higher percentage of their income on carbon consumption. Therefore a carbon tax risks being regressive – disproportionately being a burden to the poor. This is a serious concern, and it must affect how we implement a carbon tax, but it cannot prevent us from implementing a carbon tax.

There are innumerable, workable ways to help poor people (free at point-of-use health care, better public transit, guaranteed basic income). Taxing pollution could fund these programs, making a carbon tax net-progressive.

The Canadian federal carbon tax gives per-capita refunds to keep it revenue neutral, with some provinces returning most of the carbon tax revenue as rebates for low-income families, ensuring it is not a regressive tax.

And, if avoiding regressive taxes is truly the goal then we should just eliminate sales taxes and replace them with increased capital gains, income taxes, or wealth taxes, separate from the question of a carbon tax, and use these to ensure that food, shelter, water, and health care are available to all – that’s much better than cheap gasoline.

It’s also worth noting that poor neighborhoods and poor countries are often the most vulnerable to the impacts of climate change – flooding and sea-level rise may be the ultimate regressive tax, and basic fairness demands that we address this.

Other benefits

Avoiding further altering of the entire planet’s ecosystem is enough reason to cut down on our use of fossil fuels, but there are other benefits. Burning fossil fuels – particularly coal – releases tens of thousands of tons of thorium, uranium (far more than nuclear power plants), sulfuric acid, tons of mercury and lots of other nasty substances every year. Chernobyl was bad, but coal kills far more people every year than Chernobyl’s total toll. Solar, wind power, and nuclear power come with their own tradeoffs and challenges but they are all orders of magnitude better than fossil fuels.

Avoiding further altering of the entire planet’s ecosystem is enough reason to cut down on our use of fossil fuels, but there are other benefits. Burning fossil fuels – particularly coal – releases tens of thousands of tons of thorium, uranium (far more than nuclear power plants), sulfuric acid, tons of mercury and lots of other nasty substances every year. Chernobyl was bad, but coal kills far more people every year than Chernobyl’s total toll. Solar, wind power, and nuclear power come with their own tradeoffs and challenges but they are all orders of magnitude better than fossil fuels.

Current proposals

As people realize the importance of action there are multiple carbon tax proposals being made these days:

The Coons/Feinstein bill would start with a $15/ton ($0.15/gallon) carbon tax, raised by $15/ton every year (or $30/ton if emissions targets are not met) with 70% of the net revenues allocated as a monthly dividend to low- and middle-income Americans as a monthly dividend. A bit low, but solid, and with a good revenue distribution plan.

The Deutch/Rooney bill would start with $15/ton and go up by $10/ton every year. “The Treasury Department would return 100% of the net revenue back to the American people”. Even lower, but still much better than nothing.

There is also the Baker/Shultz plan which is too weak to be taken seriously, and which wipes out climate liability for oil companies, and never puts the carbon tax high enough to change behavior.

There is also the Baker/Shultz plan which is too weak to be taken seriously, and which wipes out climate liability for oil companies, and never puts the carbon tax high enough to change behavior.

Of the three I would most strongly support Coons/Feinstein.

Economists have been pushing for carbon taxes for almost a hundred years in order to get consumers to behave rationally. I think we should start listening, and should think about these different options.

So far most carbon tax initiatives in the US (including WA-732 and WA-1631) have failed. It may be that they were all flawed, or it may be that voters will only approve a carbon tax that is perfect, with every voter having a different view of perfection. Maybe that means we need better carbon tax bills (including transparency and accountability regarding how the funds will be spent), or maybe we need to start with something and then iterate to improve it. Personally I will vote “Yes” for almost any carbon tax proposal because when it comes to saving the planet I don’t want the perfect to be the enemy of the good.

Realities

Passing a carbon tax will not be easy. Change is hard. But this change is necessary, and will have myriad benefits. More efficient cars, better insulated homes, less pollution, energy independence, and jobs in the renewable energy sector are just some of the benefits. Instead of subsidizing fossil fuels we could invest in something better. And if the United States starts taking climate change seriously (dropping out of the Paris Climate Accord means we lost credibility) then that makes it easier for the rest of the world to make more progress as well.

Climate change denial

There are some who don’t “believe” in global warming. I’m not going to spend a lot of time on this but I will just note a few things:

Radically different CO2 levels – that haven’t been seen for more than 800,000 years – are going to change the biosphere. If you believe the climate simulations then temperatures will go up, among other things. If you don’t believe the climate simulations then that means that we don’t know what will happen, and performing a science experiment on our only home planet is then even more irresponsible. As an ex Cato Institute member said “Never before have we run an experiment where greenhouse gases were loaded into the atmosphere at today’s rates. We have no backup planet if things go horribly wrong.”

Radically different CO2 levels – that haven’t been seen for more than 800,000 years – are going to change the biosphere. If you believe the climate simulations then temperatures will go up, among other things. If you don’t believe the climate simulations then that means that we don’t know what will happen, and performing a science experiment on our only home planet is then even more irresponsible. As an ex Cato Institute member said “Never before have we run an experiment where greenhouse gases were loaded into the atmosphere at today’s rates. We have no backup planet if things go horribly wrong.”- The climate has changed before – but that is little consolation, because previous changes have been devastating

I’m happy to debate how best to implement a carbon tax, or whether a carbon tax is even the best way to reduce CO2 emissions. Comment away. But I have no interest in debating whether CO2 is causing warming, whether that is worth addressing, or whether this blog is a good place for this post.

Summary

A carbon tax that is significant enough to affect people’s behaviors, phased in over time, is required. Nothing else will produce the innovation and behavioral differences that are needed. Renewables are getting cheaper so it is a perfect time to accelerate the transition by making unsustainable fossil fuels more expensive. Maybe you’ll find that getting out of the car and trying more creative commuting methods will make you happier and healthier.

Thanks to Maria and Camille for their awesome edits and suggestions which improved this greatly.

A carbon tax in the US is unlikely to reduce fossil fuel consumption globally. Reduced demand in the US will only prompt more fossil fuel consumption in developing countries as the global per capita energy consumption is going up. Alternatively, the US could lead the way in funding and using nuclear power, which in my view won’t happen without active government support. That’s something other countries can emulate.

Other countries also need higher carbon taxes. As it turns out many of them already have higher carbon taxes than the US. Canada recently instituted a carbon tax and gasoline in Europe costs about twice what it costs in the US. As one of the biggest consumers of fossil fuels – the largest per-capita of any large country – the US needs to start leading, instead of following.

The federal gas tax in the US was last raised in 1993. That means that – due to inflation and increased fuel efficiency – it has effectively been dropping for 26 consecutive years. Lowering our carbon tax is the wrong direction.

The evidence for carbon tax reducing emission isn’t that strong. For instance, Germany’s efforts seem to have been in vain.

I should clarify that I’m not opposed to a carbon tax per se. Climate change will need to be addressed on multiple fronts. Tax policy alone likely won’t be enough. I do, however, think that it’s not really worth expending a lot of political capital on. That is better spent on investing in cheaper, non-carbon energy sources (especially nuclear) which will durably reduce emissions.

Right now all of the non-carbon energy sources are forced to compete with unreasonably cheap fossil fuels. That means that we have to subsidize electric cars so that they can compete against subsidized fossil fuels. At some point this becomes silly.

How do we get the money to invest in cheaper, non-carbon energy sources if we aren’t willing to make polluters pay for the damage that they cause? I want carbon-free electricity but there isn’t enough of it because natural gas is so cheap.

Fossil fuel consumption isn’t something that just happens. It depends on an entire economical/technological system, for example the oil transport system: ICE engines, jets/boats/cars, refineries, oil tankers, oil markets/futures etc.

A carbon tax would raise the costs of the entire fossil fuel system and force whatever is left to become more efficient, since development is driven by the developed countries. Furthermore, it would aid the development of other systems, that will eventually enjoy scale benefits over the fossil system. Developing countries have to use the same economical/technological system as the developed countries, and therefore will reap the same efficiency gains and end up paying some of the costs. The equilibrium will therefore be less consumption overall.

For example, developing countries would temporarily get a lower oil price due to lower demand*, and their consumption might increase – it depends on other issues, there might not be sufficient transport infrastructure or sufficient new transport or even a desire to travel more. Maybe fuel is already subsidized as already is in some developing countries. Jevon’s paradox requires the (fuel) price be the limiting factor – but where the bottlenecks are elsewhere there won’t be increased consumption.

However, every new product they’ll buy will use more efficient engines – nobody would bother developing special oil-guzzling ICE engine just for a low value market, they’ll need to use to same ICE engine they use for the developed countries and that will be a more efficient engine. It isn’t clear

Over time, oil production would adjust itself to the lower demand, and the oil price would go up again*, but the efficiency gains are permanent. Over a much longer period of time (but sped up by a carbon tax), every developed country would be working with an EV transportation system, and the oil transport system would be losing scale. Suddenly making ICE engines is much more expensive, and there’d be a necessity to switch to the transport system that is actually being under new development.

* There’s an argument the oil price is being pushed from below due to geopolitical and not market-based reasons, if so, a reduction in demand will not reduce the price by much, but rather make it less volatile.

Sigh, posted a bit too early. TL;DR:

A carbon tax would reduce demand and emissions in developing countries, and it isn’t clear at all that developed countries would increase emissions in return – that can happen only when fuel price the limiting factor and when they’d like to use more and when efficiency gains created by the new incentives are lower than induced demand. That’s rather unlikely to offset the reduced demand in the developed countries, where the majority of demand is.

Even in the worst case, the long term prognosis would be that oil production adjusts, and the developed pay about the same prices but keep the efficiency gains created by the new incentives.

Yep. Ultimately a carbon tax would need to be instituted everywhere, but the developed world, especially those with the highest per-capita consumption, need to lead the way. Once the developed countries have shown leadership then they can start applying pressure on the developing world to follow along.

We already have alternatives to fossil fuels when it comes to power production: nuclear energy. It exists, it’s 0 emissions, it’s safe. But climate lobbyists don’t want it implemented cause it’s not about clean climate, it’s about business ventures into renewable energy that creates higher income opportunities.

France has some of the lowest carbon emissions in Europe cause they rely on nuclear power. Germany some of the highest cause they are pushing for renewables. When Germany forced France to invest in renewables, France’s emissions and energy costs both went up.

We have alternatives to fossil fuels when it comes to transportation: electric and hydrogen vehicles. But they’re not really an option because electricity is still relatively expensive due to insistence on expensive, unreliable, inefficient, carbon intensive renewable technology.

We can completely eliminate fossil fuels from our society in a couple of decades if we stop letting big companies make decisions for us. But it’s all irrelevant. China and India are the two biggest polluters, and they don’t seem to be interested in change. Europe is one of the cleanest regions on the planet. So this whole scandal is backwards. Instead of making large, easy wins with India and China everyone jumped to the “diminishing returns” step already, fighting hard for a couple of percent of emission reductions.

And on top of it all, it makes little to no difference in terms of climate change. Not only is CO2 contributing only a few percent to the greenhouse effect (most of the greenhouse effect is caused by water vapor in the atmosphere), we are at an all time low CO2 level. It’s been millions of years since CO2 was so low.

[Editor’s note: CO2 levels are historically high, at levels not seen in well over 800,000 years. See the graph at the top of the post]

What does it all amount to? It amounts to using a phenomenon no one really understands (global warming) to scare the public into compliance, in order for large corporations to make more money. If you think this is a conspiracy theory, go and read up on what both sides are saying. Read how important turbines are for the electricity network and how renewables cannot replace them. Read up how devastating to the environment battery technology is. At the very least you’ll learn something new, I hope.

(In response to that sneaky Editor’s note)

How about if you extend that graph further than 800k years? How about a few million? What you’ll find is that CO2 levels in these past 800k years are some of the lowest ever seen in history. My claim is correct, do not try to invalidate it.

CO2 levels peaked at between 5000 and 7000 ppm, about 10-20 times higher than today’s, during the Cambrian period. Levels as low as in the present haven’t been present since the Carboniferous period when, interestingly enough, an extinction event took place due to climate change, as the climate went from hot and humid into dry and arid. Very similar to what’s happening today, in the presence of the same very low CO2 levels.

I would include sources, but i don’t know if web links are allowed.

Using “historically” to refer to conditions millions of years ago is an interesting abuse of the term.

You are correct that if you go *way* back into pre-history that CO2 levels were higher. If you are suggesting that it is okay to alter the climate to a level not seen since before humans came into existence then I don’t know what to say to you. If CO2 levels (and oxygen levels, if we’re going there) change that drastically then the disruption is going to be enormous, expensive, and tragic. All life on earth today (and the many cities near the coasts) have evolved for a particular environment. Changing that environment suddenly and dramatically and thinking that it’s “okay” because the environment was once that way is unreasonable.

My whole point was that CO2 levels have always been 5, 10, 15 times higher than they are today and life didn’t go extinct, climate didn’t go in a runaway greenhouse effect, or any other doomsday scenario we are being threatened with these days. What’s more, during those periods with high CO2 the climate has sometimes been colder than today.

It is undeniable that the climate is indeed getting hotter. But i see little to no evidence that CO2 is the cause. See professor Ian Clark’s testimony in front of a Canadian Senate hearing on the 15th of December, 2011.

The world will survive. Life will not go extinct. But the world is changing, and will change, and that change is going to be painful and disruptive. Florida and the Marshall Islands are going to be flooded. Coral will be bleached. Ocean acidification will harm shellfish. And much more. Climate scientists are pretty sure about this. And if their predictions are a bit off then that just means that we don’t know what will happen, which is worse.

The fact that CO2 levels were higher 14+ million years ago is just not relevant.

We’re done here. No more replies please.

[deleted]

[Editor’s note – this is not an appropriate place to debate settled science, or suggest that science isn’t constantly questioning truth. I did the suggested research and found this: https://skepticalscience.com/co2-higher-in-past-intermediate.htm%5D

Deleting perfectly fine responses that point out a serious flaw in your logic. I’m done here. You don’t care about global warming. You just care about established dogma.

There was a time when there was no or little oxygen in our atmosphere. You can actually argue that we’re at a peak level of oxygen in our atmosphere. That doesn’t mean that I want to go back to the “historical” level of no oxygen.

https://en.wikipedia.org/wiki/Great_Oxidation_Event

So, when comparing environmental levels, let us focus on the last 100k years when there has been modern humans. Whatever existed before that is pretty irrelevant.

The argument isn’t whether or not oxygen is necessary for life. The argument is that a CO2 increase from 200ppm to 4-600ppm will cause irreversible climate change, and may or may not include the end all life on the planet and possibly cause a runaway greenhouse effect, turning the Earth into Venus. As such, it is very relevant to point out that much higher concentrations of CO2 in the atmosphere had no such effect on the planet.

So i don’t see how you can honestly make the claim that CO2 has a massive impact on climate change while at the same time dismissing any data contradicting your conjecture.

Marius, we’re not ignoring data that contradicts our position. The experts – climate scientists – have looked at this. They have looked at all of this. Over hundreds of thousands of years the temperature and CO2 levels track extremely well. Over longer periods of time other factors such as the suns output also become significant. It is easy for those with vested interests or conspiratorial outlooks to cherry-pick the data, but the real scientists look at the data, argue amongst themselves, and come to conclusions. Here, for example:

https://skepticalscience.com/co2-higher-in-past-intermediate.htm

If you want to dispute the facts you need to study all of them and engage in honest debates with experts. Contradicting the scientific climate consensus on a programming blog is not the way to seek truth.

We are suddenly and dramatically increasing CO2 levels. That is indisputable.

If the scientists are right then temperatures will increase and our lives will be significantly disrupted.

If the scientists are wrong then we don’t know WTF will happen, and that is even worse.

“It will probably be fine” if we alter the earth’s atmosphere is not a strategy.

I go to a stadiums to watch sports. I go to concerts to listen to music. I go to blogs for programming tips.

You don’t have to read this post, but I would be derelict in my duties as a human being if I didn’t write it.

Bruce, I don’t resent the misguided global warming group of which you, and Greta Thundberg?, are a part off. The deceitful scientists and politicians present a compelling story to some. After all the polar bears are thriving*.

I won’t stop reading because of our differences on this. I will fight for lower taxes at the ballot box, not fight your group.

I too would be derelict in my duties as a human being if I didn’t keep telling all an oppressive government is far worse for humanity than global warming. So I respect you and your passion so I’ll keep reading.

——

*https://polarbearscience.com/2019/07/11/polar-bears-are-thriving-despite-global-warming-this-short-essay-explains-why/

I’m not a polar bear expert so I’m not going to debate the specifics of that issue, but I’m curious about your beliefs on some related details:

1) Do you acknowledge that the climate is warming?

2) Do you acknowledge that ice is melting and the ocean is rising? Florida’s gonna have a bad century.

3) Do you acknowledge ocean acidification?

4) Do you at least acknowledge that CO2 levels in the atmosphere are going up?

If you deny those four points then I don’t know what to say. If not – if you believe those realities – then polar bear survival is grossly insufficient for optimism. We need to burn less carbon, full stop

Not many are polar bear experts and neither was Mr. Gore; you connected the dots, I’m sure.

To answer you:

1. I acknowledge the earth cyclically warms and cool; yes

2. This is the polar bear connection here.

3. I skimmed over; I’ll catch up.

4. Yes. The way to solve this is very complicated.

[Editors note: several paragraphs deleted due to being off-topic (US history) and because I don’t want to waste space on my blog debating with someone who doesn’t acknowledge human-caused climate change is happening now]

…

5. If government could do it, I am with you. They can’t. It’s you and me and our friends, family and neighbors. Don’t use “dirty” products. It’s that simple.

…

Your plan is basically the status quo. That’s not working. We need to try something different, to give incentives to reduce the use of “dirty” products.

Deleting perfectly fine responses that point out a serious flaw in your logic. I’m done here. You don’t care about global warming. You just care about established dogma.

Wait a minute, are Cristi Neagu and Matt Fisher the same person? ’cause they wrote identical responses.

I’m interested in debating solutions to the problem of global warming caused by releasing carbon dioxide into the atmosphere. The political history of the US is too far off topic, and whether CO2 is causing global warming is settled science that should be challenged in different forums.

Holy cow, this one really brought the climate change deniers out of the woodwork, huh? Thank you for writing about this.

Not a lot of people here denying climate change. Just people arguing about the cause of climate change and the policies that should be implemented.

It sure did. It’s funny that the climate change deniers even deny that they are climate change deniers. For the purposes of this discussion a climate change denier is someone who denies the settled science of anthropogenic climate change – warming and other climate changes caused by us burning vast quantities of long buried carbon.

I don’t know how anyone can look at that hockey stick graph of CO2 levels and think that it is somehow okay and not risky, but here we are.

Sure. Let’s change definitions to mock people.

A climate change denier is someone who denies climate change. What you’re referring to is a climate science denier. Quite different things.

We are not the same. I copied his/her answer as we were apparently treated the same.

I (we) provided reasons why your theories are wrong and all you can do is delete. That’s a cheap shot.

We must cap the fossil fuels production. This is both necessary and sufficient.

Carbon tax may or may not be helpful. It may be necessary but is not sufficient.

Once production is capped the fuel prices will skyrocket and the free market will do the rest – poor people starvation, WW3, etc.

Capping fossil fuel production cannot work. There are enough dictatorial regimes on the planet with sufficient reserves to ensure we all boil – Russia, Iran, Saudi Arabia, etc. We are unable to contain their oil production – we’re barely containing them as is. Capping our own production will merely cede marketshare to them but won’t change emissions meaningfully.

This fossil emissions problem will have to be solved on the demand side.

Is still think that capping fossil fuel production is both _necessary_ and sufficient. Not capping And I also agree with you. Except the final sentence – IMHO the emission problem is not solvable. It seems that we are doomed. Carbon tax may work on a very short term but in long term will be highly ineffective. Partially because of regimes with sufficient oil reserves like Iran, Saudi Arabia and Russia.

Excellent synopsis. Thank you for it. One point on which I might disagree with you is when you say:

“Personally I will vote “Yes” for almost any carbon tax proposal because when it comes to saving the planet I don’t want the perfect to be the enemy of the good.”

I’d be concerned about a situation where congress, particularly one with a Republican majority, passes something ineffective like Baker/Shultz simply as a defensive measure to avoid taking up anything better. They’d claim that they “already passed HISTORIC LEGISLATION to protect the earth and LEAD THE WORLD in taking MEANINGFUL ACTION to combat climate change” (or some other ridiculous delusion).

I 100% agree. Baker/Shultz looks like it hits $60/ton around 2030. That’s equivalent to $0.60 a US gallon. That will be 37 years after the gas tax was last raised and is really little moire than adjusting that for the intervening inflation and increased fuel economy. It certainly isn’t enough to change people’s behavior.

I want to thank you for putting this on a programming blog (and one that I do follow). The “it’s not my job” complacency that so many carry allows these things to continue without abatement (literally, in this case).

The way I see it, the world undoubtedly needs to become carbon neutral at some point. Emissions will not stabilise until then, and for as long as we are forcing a change, change will continue. Even for those that feel the IPCC is wrong on 2C being the upper limit of what we should accept, surely we all must agree that there will _be_ an upper limit.

And we cannot reach that equilibrium as long as people can dump for free. As long as it costs firms nothing, they will. So there simply has to be a carbon price. I see no way around this.

And how much will carbon neutrality cost? Well, estimates for Direct Air Capture range from $100 to $300/tonne. That is an _upper limit_ on how much mitigation can cost, where you have no choice but to emit it and then suck out those emissions somewhere else. Most reduction comes at a tiny fraction of that cost, whether it’s capturing at source, or avoiding emitting in the first place.

Consider France. 4.6t/capita, and they got there mostly through low cost policies. If we were to assume that everything left is unavoidable (it’s not), and the highest estimate of cost to remove… that’s a grand total of $1380/capita/yr. A whopping 3% of GDP, or what would be recovered in about a year of growth if the world wasn’t in such chaos right now.

The main reason there’s so much lobbying against what ultimately is quite a solveable problem? Honestly, it has to be the trillions on trillions of dollars of vested interests, that a price on carbon would fundamentally disrupt, in favour of greener industry. It’s a massive tragedy.

Thanks for your post! I’m happy to see this call for action. I’m not living in the US but the US is in many ways seen as a trend setter (or anchor) so I’m affected in many ways by US’ policies.

As others have already pointed out, the trick will be to somehow avoid exporting the CO2 emissions like we have done the last decades. It would be great if a CO2 tax could also apply to imports, but the details there will be tricky. Maybe the best is to make it part of trade agreements the same way the US enforces copyright law.

It’s also depressing to see people debating at the “is the earth really round” level. I’m never sure if that is trolls thinking they are funny or not, but I suspect it has a lot to do with personal fear. Admitting that there is a problem means admitting that we are a part of the problem and need to change and change is scary and sometimes painful.

In the end, if we can get through the next couple of decades, I think the planet will be a nicer place for everyone. In a hundred years people will look back at this time and shake their head when told we dug up coal and oil and burned it. But first we need to make it there and it won’t be easy.

I came here to read about computers, not alarmistic propaganda.

If you don’t like the content on this free blog then you are free to not read it. It’s a big Internet.

Amen brother.

Earlier, I provided a logical rebuttal to these carbon emissions arguments and guess what?

Just like all liberals dissent was silenced/deleted; Like it never happened…hasn’t this exact situation happen with carbon missions? “Scientist” silence dissent; better get they provide false data? Yes they have. Want proof? Even if I attached it, it’ll be deleted.

Ideas have to be challenged by dissent; Otherwise it’s just pattycake between two sides.

Best idea wins.

Watch: if anyone provides proof otherwise, Bruce will delete it.

I’ve had two of my replies deleted so far. One had the text edited out and the other was rejected before it even made it here. The claim: Discussing whether or not CO2 emissions are creating a climate crisis has absolutely nothing to do with taxing CO2 emissions because they are creating a climate crisis.

If you don’t want your replies stuck in moderation (it was auto-tagged as spam) don’t write 499 word replies. That’s a blog post, not a blog comment. Feel free to debate the IPCC report on your own blog.

I see a pattern; delete dissent.

Sure, that’ll work in your blog and even in your head. That doesn’t make issue solved, though.

As a result, your not helping anyone or the earth.

FFS you three. I want this page to be about how to reduce carbon emissions. I don’t want it to be a discussion about *whether* we should do that. It’s my blog, I pay for it, so I make the rules. There are lots of places you can go to defy the scientific consensus.

We are adding gigatonnes of CO2 to the atmosphere. This is acidifying the ocean. CO2 is a greenhouse gas. These three points are debatable.

Decades ago Exxon predicted this would cause global warming. The scientific consensus is that this is causing global warming. You have found some scientists who disagree. Congratulations. I’ve read your alternate explanations but they are not compelling, and I think that they amount to saying “it’s okay to run an experimental change in atmospheric chemistry on our only planet, and the rising temperature is purely a coincidence.”

If you are ever in Seattle we can discuss this over a drink. Or you can debate it elsewhere on the Internet. This blog post is for discussing what to do about it.

But this isn’t about how to reduce carbon emissions… We already know how to do that: nuclear power. No, this is about creating a massive tax burden on the population, one that would impact anyone and everyone, reaching deep into all industries. So before you upend the entire economy i think it’s entirely fair to question the basis of your motives.

I’m all for reduced emissions. At the end of the day, it doesn’t really matter if cars are killing the planet or not. Exhaust fumes stink and they’re toxic and i think everyone would agree we’d be better off without them. But we have to get our priorities straight. Taxing everything that generates CO2 has such a huge impact that it must be carefully considered. Creating incentives is better than creating penalties, but it also takes longer. And since you come with alarmist propaganda you are basically telling us there is no time left for anything other than punishment and upheaval. And for what, exactly? For cleaning up the cleanest some of the most efficient countries from a power vs CO2 generation point of view, while the big offenders that might as well be burning tyres go on unchecked.

So yes. Questioning your motives is entirely valid. This isn’t a hypothetical discussion. This discussion is happening in governments in Europe and the US (mostly because no one else gives a crap about emissions). And when it comes time to vote, this hypothetical discussion will have massive consequences.

Anyways, have it your way. Just remember that we tried having a civilised, reasoned discussion and you did your best to shut it down. People who shut others down aren’t usually on the right side of history.

Have a nice day.

289 words – for you that is short. But still too long.

> i think it’s entirely fair to question the basis of your motives.

By “basis of your motives” you seem to mean whether CO2 causes warming. It does. You can go elsewhere to question that. Sorry.

I agree that nuclear is a necessary component of the solution. I think that taxing carbon – taking away its subsidy – will help nuclear (and solar and wind) compete, and is crucial to solving this problem.

See? I’m happy to debate how best to reduce carbon emissions. But I don’t regret deleting your attempts at debating whether CO2 is causing warming. And, I find it hard to spend much energy debating how to reduce global warming with somebody who doesn’t think it is happening.

I am convinced by the science and I agree that your logic regarding taxation holds but I still don’t see how we can effectively avoid the tragedy of the commons. Even if we lead, how do we get the largest polluters like China and India to follow that lead? They have wildly different perspectives and ambitions and (nominally) are even more willing to put their populations at risk (and they do) than the US and Europe. They already play very unfairly in the global economy so I’m concerned that whatever they commit to will be a sham. More at home, California leads the nation with some of the most progressive policies and it has successfully convinced many other states to adopt the same or similar policies. But we have many states (and frequently the feds) that do not and will not for a plethora of reasons.

So while carbon taxation may be a necessary precondition to get us out of this mess, I fear it’s unworkable in the timeframe we have. A “modest proposal” such as this is really only modest for people of some means because we can afford to wait a little longer until things line up. I wonder if you’ve ever read The Skeptical Environmentalist and considered some of its proposals or the central theme that we can focus on more achievable incremental goals without losing sight of the big picture. He has a section on climate change but since the book was written in the early ’00s, most of the science is from the decade before. I didn’t research if he’s changed some of his views.

Split for length.

The problem with that argument is that right now the USA is, arguably, the biggest free rider in this ongoing tragedy of the commons. Its per-capita emissions are greater than most (certainly far higher than China or India), presumably because its carbon taxes are lower than most other rich countries (for “a plethora of reasons”, as you say).

The Paris climate accord rightly acknowledged that we can’t expect poor countries to decarbonize as quickly as wealthy countries. The USA needs to lead along with Europe and others, instead of using China and India as an excuse.

I don’t see why a carbon tax is “really only modest for people of some means” if it is returned as a per-capita rebate. Low-income consumers probably emit less carbon than average so they could come out ahead – better if bus service improves.

Lomborg wrote a follow-on book about global warming. My impression is that it continues his core claim that fighting climate change would cost more than the damages. That is a bold claim given the uncertainties, and it certainly doesn’t justify subsidizing fossil fuels. I tend to think that some carbon taxes (especially if implemented twenty years ago) would encourage efficiencies and actually *save* money. We are hugely wasteful in our energy use right now. Sure, a $1,000/tonne carbon tax would be disruptive/expensive, but can we at least start and see how it goes?

But are per capita emissions what we should be focused on? Doesn’t the tragedy of the commons come from absolute emissions (the commons being the states of the world, not the people)? Again, I’m not suggesting we give up, I just don’t see how we can reach our ultimate goal with this plan. If we reduce our dependence on carbon energy in a way that gives us a short to mid-term economic advantage over the biggest absolute polluters then *maybe* that will convince them to use the same approach in order to compete. I just don’t know if this is it, given a lack of political will and Americans’ convenience culture.

Also, could you speak a little more to the idea of nuclear? If we made a concerted effort to override fear, especially in the younger generations, could it pay off in time or do you think the cost in various forms of capital outstrips its benefits more than that of a carbon tax?

Are per-capita emissions the right metric?

Yes.

To do otherwise is to say that Rwanda and Belgium should be allowed to emit 30x as much per-capita as the US. It is to say that the citizens of China and India should be penalized for living in a populous country.

If per-capita is the right metric then the US is over budget.

If per-country is the right metric then the US is even more over budget, at 13.77% of the world total (second *only* to China).

https://en.wikipedia.org/wiki/List_of_countries_by_carbon_dioxide_emissions

I agree that convincing Americans to pay more for carbon (even though a tax can trivially be returned to them) will be challenging, but that is not a reason not to push for it.

I think that nuclear is probably a necessary component since it can provide a carbon-free base load of electricity.

Regarding people of modest means, the expectation for Canada’s carbon tax is:

“70 per cent of people in those provinces will get back more than they end up paying out as fuel costs rise to include the carbon tax.”

https://globalnews.ca/news/4586374/carbon-tax-rebate-what-you-need-to-know/

This makes sense. If you tax carbon and then give a per-capita refund then everybody who uses less than the average amount of carbon will profit. Most people use less than the average amount of carbon.

Note that even though 70% of people will get more back *everybody* has an incentive to use less carbon

For this group: “ Most people use less than the average amount of carbon.”

What about going into that individuals residence and looking around. Find their soap. Find their ceiling fan. Find the wood studs in their walls. Find the air conditioner. Their plane ticket to Cabo. Their auto gasoline bill to work. On and on. Everything in there was moved by an 18 wheeler from manufacture to the store they bought it at, or everything was that individual moving around.

So, they are the carbon consumers? These companies these individuals buy products from are what these individuals purchase product from. Then tax them, right? Well, they aren’t going to eat those costs; they will pass on to consumer who “…use less than the average amount of carbon.”

There is a hole in this theory?

The little guy you are referring to is the main carbon consumer?

Yes, we use carbon both directly and indirectly. Yes, we buy products that are delivered on a 18-wheeler that burns carbon. If carbon is taxed then the cost of these things will go up. A little here, a little there. These extra costs will be passed along to the consumer. So our median household might pay an extra $500/year because of the tax. So far we are in agreement, yes?

Now multiply that by 300 million people to give us $150 billion in carbon tax revenue. Now divide that by 300 million people and they all get a $500/year tax rebate. That part is crucial.

That assumes that everyone uses the same amount. However the rich consume much more carbon (more flights to Cabo, bigger houses, more consumer goods on 18-wheelers). So they pay more per year in carbon taxes, so our median consumer who spends an extra $500/year due to carbon taxes actually gets, say, $600 back.

Make sense? The carbon tax rebate means that living doesn’t actually get anymore expensive, but suddenly everyone has an incentive to be a bit more efficient.

I follow you but think there is a giant hole in this…We are the carbon consumers. You and I and our neighbors. So much so, many think the globe is doomed in 12 years. We, collectively, are the carbon burners; there are no business. We buy from them. We are 100% the burners. If we are the burners, and we get lute back, where is the carbon savings? Where is this differential that warrants raising taxes that will solve this? It does not make sense, we get a credit but are 100% of the problem. How are higher taxes fixing this?

Good question. Let’s imagine that you knew that gas and heating-oil prices were going to start going up. What would you do? Well, you might start shopping for a more efficient car because going from 20 mpg to 30 mpg would be saving increasingly large amounts of money. Or you might insulate your home, carpool, or buy local produce instead of produce shipped in from Mexico.

If you made these changes – using less carbon – then you would be spending less on the carbon tax. If you made more of these changes than most people then you would get a nice windfall. You could easily end up paying only $300 extra because of the carbon tax, while still getting a $500-$600 rebate.

If you didn’t change your lifestyle at all and everybody else did then you would continue to pay the same amount in carbon tax but would gradually get a smaller rebate.

… There is no way 70% of the population is going to get a better deal here. The products with no carbon tax in them are going to be more relative to the cost of product with the carbon tax on them. So an individual is going to pay more for the product to avoid the tax? It makes no sense. This individual may save $500 a year but they will spend more purchasing the carbon tax free products.

The way to solve this problem, which is leave the world a cleaner place then you entered in it, Is to incentivize clean products. Not through taxes; through incentives then the free market that you speak of will find a way to earn that loot. For example, offer $1 billion to the first outfit who can turn nitrogen into energy (Or whatever abundant element). As another example, remove the tax burden from the companies who provide clean products.Taxing the individual to oblivion will only lead to a revolution. We’ve been through this, right? Our only hope is in the power of the individual to think invent grow learn. And to do that an individual cannot have a significant tax burden. I currently pay over 50% of my income and taxes. And I’m not rich I can’t go buy anything I want to. My kids are not going to a upper echelon university. I’m just plain old middle class and the government taxes the daylights out of me today. I can’t give them more of my money to burn. No pun intended

> products with no carbon tax in them are going to be more relative to the cost of product with the carbon tax on them

Some explanation for this would be nice because this seems to make no sense.

> The way to solve this problem … Is to incentivize clean products

You are *so* close to understanding my point.

> through incentives

Paid for how?

A carbon tax makes carbon intensive products more expensive. That lets innovative solutions compete fairly. And this will not increase your tax burden if the carbon tax is returned to the people.

I’m sorry you are paying so much in taxes. If you are in the US then I’m not sure why your tax rate is so high – my total tax burden is much lower than 50%, although that rate doesn’t cover healthcare.

Example:

1. Cost of Bottle of shampoo today manufactured by outfit with a smoke stack and delivered with 18-wheeler: $5

Into Future After Bruce’s Carbon Tax (BCT)

2. Cost of Bottle of shampoo after BCT manufactured by outfit with a smoke stack and delivered with 18-wheeler: $6

3. Cost of Bottle of shampoo after business changes due avoiding BCT manufactured by outfit without a smoke stack (wind power?) and delivered my car with nuclear reactor (kidding, electric): $7

Household #2 will receive no rebate so they are in the hole $1

Household #3 will receive rebate but paid more for their products which makes rebate vanish, if not negative. This $500 will pale in comparison to higher cost of carbon emission free goods…

We are all taxes this rate and don’t know it. Our federal rate might be 20%, our state another 10% (on income, property, sales tax). Then there is embedded taxes in gas, hotels (30%!), electricity bill, phone bill, cable, insurance, employer payroll tax (6%), airline, licensing, on and on. The grand total is we all pay significant tax, hidden or not.

The US corporate tax rate is high; maybe highest in world. The people pay that tax. Me. You (do you live in US?), and our friends, family, and neighbors.

Incentivize clean products by lowering those genius producers tax burden. It’s the polar opposite of your suggestion. Incentivize I believe will spur real change. If taxes increase, politicians will waste it and no cleaner earth. Keep that money in hands of the earner but guide them to clean products via tax break incentives. Let the free market do its thing.

I bow before the power of your entirely made-up numbers.

Your assumption seems to be that renewable energy is so expensive that even when a carbon tax is instituted it will still be hugely more expensive – so expensive that it adds 40% to the cost of shampoo. In fact, renewable energy is quite competitive already with coal/gas already. That is one reason Google (not a charity) is able to use 100% renewable energy. Renewable energy costs have been dropping, and continue to drop, and are very often the cheapest or close-to-cheapest option. A carbon tax just accelerates this inevitable transformation.

https://en.wikipedia.org/wiki/Cost_of_electricity_by_source

You keep mentioning tax-break incentives. However that is not a real proposal unless you mention where the additional revenue to pay for them will come from. Perhaps from… a carbon tax?

Most numbers here are an authors intuition.

Fair enough if they’ve been dropping; the ones I’ve seen have been high.

The wind option on my electric bill is way higher than conventional electricity.

Tax incentives? Lets start here:

“$930 Million: On unnecessary printing costs.

Federal agencies spend an estimated $2.6 billion on printing. Many of those trees could have been spared–such as the ones used in the $28 million spent on the daily printing of over 4,500 copies of the congressional records, which are also available online.”

… The federal government is notorious for stupid spending. Have you seen the cost/student v their grades over last thirty years? One might think scores go up as dollars towards student does? Nope.

Shall I go one? (Let me know if you want links but you haven’t in past so I obliged here)

No not from BCT! Taxes are counter to free market.

Please stay on topic. Optimizing the federal budget may be a worthy tax, but you need to do that elsewhere or risk comment deletion.

Taxes are the price we pay for living in a civilized society.

Amen: I’m all for went taxes, i.e. civilization.

Finally, I love your blog but I think you kind of stepped into it with this post. I don’t know what your readership is but if you feel it’s your duty as a human to explain and promote a potential fix for climate change, I’d say there are much more efficient ways to reach people. The biggest drawback as you saw was that you had to shut down several posters and that never looks good unless they’re engaging in ad hominem attacks. You know that, especially in what I gather to be your readership, you shouldn’t have any fear of the comments section to a post mis-educating a reader. I would have let my work stand for itself in (what seems to be) this first potentially controversial non-programming post.

Oh, and check out this blog, hilarious and educational all at once: https://waitbutwhy.com/2015/06/how-tesla-will-change-your-life.html

I felt I had a duty as a human to write this. Plus I learned a lot while writing it. If there are more efficient ways to reach people then I’m all ears and maybe I can do those as well.

I think that those who don’t (want to?) believe in climate change succeed when they sow uncertainty. There is no uncertainty about the existence of human-caused climate change (and other consequences of CO2 emissions) and if I leave up comments that suggest that there is uncertainty then I am helping climate deniers.

I’m still not sure how to deal with those comments. I welcome discussions of whether carbon taxes are a good idea, but those who want to debate whether we need to reduce carbon emissions can discuss it elsewhere. That is now my policy.

Medium posts, LinkedIn posts, distribution on Twitter, a letter to the Chronicle and every other newspaper that will listen? Is that too much work 😉

That’s not too much work – I should do those as well

Lomborg’s latest thoughts about carbon taxation (and everything else).

The Nobel prize winner (Nordhaus) which Lomborg references at the beginning is discussed here:

https://www.econlib.org/library/Columns/y2018/MurphyNordhaus.html

They say that Nordhaus’ estimate of the “social cost of carbon” in 2025 has almost tripled in less than a decade to $44/tonne. Doesn’t that uncertainty worry you? Lomborg and Nordhaus thinks the safe thing to do given this uncertainty is nothing. I think that is the risky thing.

Note (to other readers, really) that the “Skeptical Environmentalist” absolutely endorses the science of the IPCC report. He believes that one to three feet of sea-level rise by the end of the century is a good estimate. How many cities does that drown?

Lomborg agrees that global warming is happening, he just thinks it isn’t worth fixing. I think at the very least we should implement enough of a carbon tax to encourage efficiencies instead of waste. Making our cars more efficient doesn’t actually cost *anything*. The choice between reducing carbon usage and economic growth is, for now, a false choice.

I just don’t understand why a risk of three feet of sea-level rise by the end of the century, with lots more to follow, isn’t treated as more of a priority.

For those who claim that reducing carbon usage is too expensive, take a look at this article:

https://www.theguardian.com/global/2019/nov/02/labour-scheme-homes-energy-efficiency

There are a lot of inefficiencies waiting to be fixed. A carbon tax can help encourage these, and can help pay for them.